28 May 2019

Reach Markets publish the notes from our analyst meetings with company management. They should be read in conjunction with the research we’ve completed. Reach Markets endeavour to provide self-directed investors a seat at our investment meetings. We publish these notes in a conversational format to get these out as quickly as possible for your consumption.

We recently had a one-on-one meeting with Andrew Gunn, Senior Manager Investor Relations of BHP Billiton Ltd (BHP). The meeting was used as a refresher on the BHP story as well as to reassess our investment thoughts on the Company. Much of the meeting responses were largely as expected. Below are the key points from our discussion.

Portfolio simplification ongoing.

BHP’s strategy hasn’t been changed over a number of years, which is having a simple portfolio of diversified base commodity and tier one assets and the company tries to maximise the value of these assets by improving and maintaining culture, operational excellence, technology and capital discipline, all of which combine together to maximise value and return. The Company has a more positive outlook for copper and petroleum and that’s driving its strategy, in terms of capital allocation and developing assets. BHP recently announced sale of onshore US shale assets as a part of its portfolio simplification program, after which the combined asset disposal has reached $18bn over a 5-year period, and the portfolio is now centred around large value assets. The Company has reduced its operated assets from 30 to 13 which has seen an increase in average size of resource per asset. Roughly 80% of BHP’s assets have an asset life of more than 50 years and are low cost.

Petroleum business.

The Company focusses more on the long term prospects rather than day to day happening of the market, when they make investment decisions and that’s a reason why it likes petroleum (attractive long term supply and demand fundamentals) on which Mr. Gunn noted in the words to the effect of, “we see reasonable demand growth of around 1% per annum but you also have natural field decline which puts you around 3%-4% pa, which basically puts you on a treadmill even if there is no demand growth because you are replacing volumes on an ongoing basis. Over recent years there has been a pullback in terms of exploration spend in many commodities, with current decline rate of 3-4% pa and its growth, essentially we have to replace 1/3 of current production over the next decade (around 2025) and that’s the lowest production to replace and therefore prices need to be sufficient to induce that production.”

BHP has been in the petroleum business since 1960 and has proven operatorship in conventional oil, which gives us confidence of it being a good operator, so we think it is a very good business for BHP going forward. On a 10-year average, the Company has got some of the lowest finding and development costs vs peers and over recent years it has come up with a more focussed exploration strategy. Moreover, BHP has got good options like 30 brownfield projects with average returns of about 40% which could help offset the natural field decline that the industry is experiencing. BHP’s average cost of conventional oil was US$10/boe in FY18 and the Company thinks that it would be US$11/boe in FY19, which delivers them a very favourable cash margin, if we compare it to current spot price of around US$80.

Iron Ore.

BHP has a very good iron ore business and we think it’s well positioned to benefit from what is happening in China now, in terms of the pollution reforms and supply side reforms in the steel industry. Chinese steel mills are currently running at an average utilisation of 80%, and to increase it they must buy higher quality raw material. Moreover, to reduce the pollution the mills must increase the quality of the iron ore (superior quality ore requires less met coal in blast furnace so produces less pollution) and these situations works well with BHP’s mix, which has an average iron ore grade of ~61% and average lump percentage of ~25%.

The Company has a project (replacement mine) coming around 2021 which would increase average grade of its portfolio to 62% and lump percentage to ~35%. The Company thinks that there shouldn’t be too much of a demand increase this calendar year, but they do expect additional supply to flow in from major players; hence iron ore pricing to have downside risk. BHP also expects their iron ore cost curve to flatten over time more from increase in supply from increasing productivity rather than major capital investment.

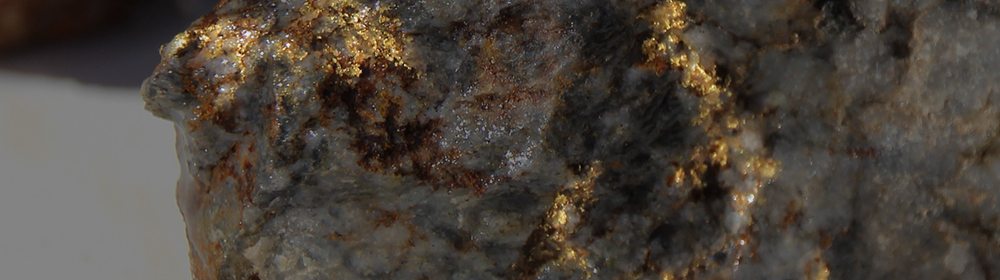

New IPO

Gold explorer currently undergoing an IPO. Seeking fast track to production. Register to receive the prospectus upon approval.

No impact from trade war between China and the U.S – yet?

Gunn noted (in the words to the effect of), “we haven’t seen any physical impact of trade war but we expect if everything comes in it should have a potential impact of one quarter to three quarter of a percent on Chinese GDP growth and it would be similar in the U.S., but that’s before factoring in any mitigating policies that Chinese government may implement to offset that impact…we expect Chinese GDP to come around 6.5%”.

BHP also noted that currently, there are no impacts on their supply chain in exporting iron ore.

Potential cost reductions

BHP provided medium term unit cost guidance for iron ore for FY19 of US$13 (all in cost basis), US$11/boe for petroleum and US$1.15/pound for copper and the Company is planning to achieve that target through productivity improvement on which Mr. Gunn noted in the words to the effect of, “we have a pipeline of productivity initiatives with a lot of work around automating trucks, rails etc. If we compare to peers, our unit cost was US$13/tonne in FY18 on a C1 basis. We have delivered more than US$12bn of productivity gains over the past 7 years, reducing unit cost by over 30% and we very much expect to continue this journey going forward. There are 3 large initiatives that we are looking at in addition to more day to day ideas that we continue to implement…at functional level we have got a program … around streamlining processes and reducing bureaucracy and that will clearly have an impact and a flow through effect to the cost base. We have also got what we call the BHP operating system, which is around standardisation of work and why we think this is particularly powerful is because rather than being a top down approach where management takes all the decisions, we will empower people at the front line to come up and share their ideas and implement them around the organisation. Then we have our automation program, where one thing that we are doing is that every mine is implementing lasers and weigh scales that make sure we have optimal level of iron ore filling in each trains, which will make sure that trains running across the rail are balanced and not over or under weight”.

Samarco – the issue still remains outstanding but manageable in our view.

Gunn noted (in the words to the effect of), “we talk about Samarco around 3 key buckets; rehabilitation, legal developments and restart expenses. Rehabilitation and compensation has been facilitated through a foundation that we, Vale and Samarco has set up…there are 41 programs of work there…for legal, the framework agreement was established with the federal authorities and we have announced a governance agreement with the prosecutors that settles one of their claims; the US$20bn Rio’s claim and its sets the framework for discussion with the prosecutors for any modifications required to those existing programs using the existing frameworks that are kind of being set up to settle the larger of the prosecutors claim. BRL$20bn claim has been settled and BRL155bn claim has been suspended while we work with the prosecutors…we have a provision of US$1.3bn for the liability (BHP’s share)”.

The company has not provided any timeframe for the restart of the mine