28 May 2019

Reach Markets publish the notes from our analyst meetings with company management. They should be read in conjunction with the research we’ve completed. Reach Markets endeavour to provide self-directed investors a seat at our investment meetings. We publish these notes in a conversational format to get these out as quickly as possible for your consumption.

We recently had a one-on-one meeting with Garry Carroll (MD/CEO) and Sharyn Williams (CFO). The meeting was used as a refresher on the GEM story as well as to reassess our investment thoughts on the Company. Below are the key points from our discussion.

Market conditions and revision of GEM’s view on supply/demand rebalance.

The company has pushed out its view on when the supply/demand equation will balance. They originally expected supply to reduce quicker on the back of access to capital (which is working its way through) and economic rationalism (assumed that new developers wouldn’t keep building a centre if there are other centres already in the area).

The second assumption has proven to be an incorrect assumption, on which Mr. Carroll noted in the words to the effect of, “with an individual the only way they are going to get paid is to finish building the centre, so the existing pipeline has continued on that basis. It would have been nice if there had been an increased level of economic rationalism but we have reconciled ourselves to the facts that it won’t happen so the existing pipeline would get built but there won’t be many new additions to the pipeline because of credit constraints, the net result of which would be that in 3Q19 we will have improved demand conditions and supply growth and slowly growing back we should be more in balance in late FY19. It is a little bit longer than we originally thought but we haven’t seen anything lately that would reduce that speed even further.”

Opportunistic new operators.

Mostly driven by individual developers, to capitalise on demand growth on the back of the recent legislation passed to change the childcare subsidy. However, management believes these operators are short-term opportunistic players – that is, it’s a great opportunity to acquire a piece of land, build a childcare centre on it and sell it on the promise of increased demand. Hence, several new operators have entered the market with an intention of building the centre and selling it to the larger operators. However, given the challenges being experienced in the industry and larger players closing up their bank books, these new operators are now being forced to operate the centres. The company believes in the next 12-24 months, as the competition increases, these new operators will get to a stage when they have to get out of it and that’s the opportunity established operators like GEM to potentially pick up assets at attractive prices.

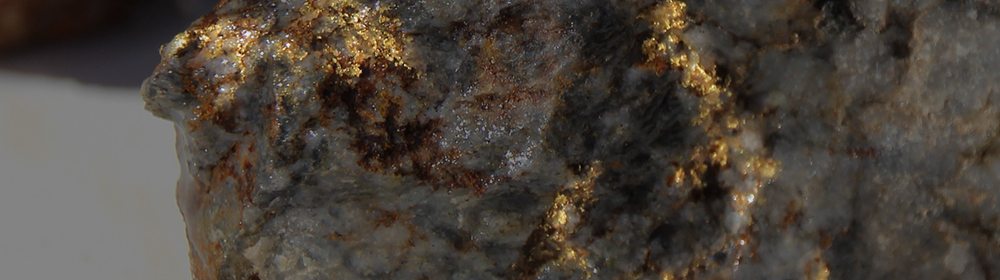

New IPO

Gold explorer currently undergoing an IPO. Seeking fast track to production. Register to receive the prospectus upon approval.

Capital constraints.

Carroll noted in the words to the effect of, “banks have worked out that they are overweight on the development side of the sector and they track the same matrix we track and they see supply run well ahead of demand growth so they have reduced significantly lending to the developer. If you are a new developer in the sector you won’t get any money, if you are an existing developer they want to be really clear on your trading track record, if you are operating they want you to have a capable experienced credit operator that you have already lined up as a condition to financing.” The supply growth slowed in 2Q18 because of the capital constraints, with the company waiting on the September data to find out if it has continued to slow down. Supply continues to grow but the growth rate is moderating.

Potential for rent reduction.

The company has had successful conversations with landlords regarding rent reduction when it went through a market review to get a better balance between their expectations and the market, on which Mr. Carroll noted in the words to the effect of, “we have had some degree of success there…you have to take the market into account when you are looking at your rent, whether you are asking for a 20% increase or a 10% decrease”. Whilst the company continues to hold meetings with its landlord, they noted we shouldn’t expect widespread rent reductions.

Industry consolidation.

The company thinks that consolidation will occur, but it won’t start occurring for at least another 12 months because individual operators have just passed the fee increase and they would wait which should support earnings in the short term. However, over the medium term the company expects “the industry structure moving from 25% little guys and 25% scale to 50-50.”

Occupancy levels.

The company thinks that occupancy levels have moved in the right direction in the 2H18 and we think the self-help initiatives being undertaken by GEM like establishing a centralised call centre in 1Q19, reduction of team turnover and quality improvement of programmes should

Inflationary pressures and initiatives to mitigate them.

Wages have increased by 3.5% in July 2018 and the company has an outlook that in the worst-case scenario the wages should increase by +5.5% from 2020 onwards and to mitigate its impact the company is undertaking a couple of initiatives including; selecting and implement a new roster system which would automate and standardise its rosters (at the moment GEM’s rosters are manual and non- standard and they don’t use things like regional casual labour pools), which according to Mr. Carroll would save the company “high single digit millions of dollars” per annum. Moreover, the company has set a target to potentially reduce by 50% its current level of turnover over the next 2-3 years.

Regulatory pressures on wages.

The educator-to-child ratios have been stable (1 to 4) from the beginning and the company doesn’t think they are an issue in terms of potential increase in scrutiny.

Where Mr. Carroll thinks the scrutiny could come in is the qualification of the educators, on which he noted (in the words to the effect of), “one of the outcomes of pushing preschool down to 3 year old’s is that there will be a requirement of having qualified teachers in that room and that is actually a good thing. The qualification requirements of early child educators may be an area the government could look into and increase scrutiny there but I think there is not much further they can go because I don’t think anyone would say they need a bachelor fully qualified teacher to take care of a 6 month old, so I don’t think it will happen in that room. Whether it gets pushed down to the 2 year room is also pretty debatable.”

We think GEM being a scale operator can provide a good level of training at a reasonable cost which gives them an advantage over the smaller operators.

Impact of subsidies on occupancy.

The occupancy has continued to trend higher in July and August and has been growing slightly better than last year and Mr. Carroll thinks 85% of their customers are now better off financially if their out of pocket cost before and after the subsidy is compared but it has been a very mixed game on which he noted (in the words to the effect of), “what’s been fascinating for us is that we have lost some of the very high income earners. What’s interesting is looking at the geographic impacts, so towns like Townsville and Bundaberg have suffered occupancy falls straight after the subsidy and it certainly wasn’t high income earners but it was actually single working parents who fall in the middle income family category, and they struggle with the activity test so their number of subsidised hours drop. So a number of those went from 4 days a week to 2 days a week versus areas of western Sydney where there are dual working parents and are quite substantial dollar winners have taken more days. Across our entire network the positives outweigh the negatives but they have been very different region by region and family by family.”

Pricing dynamics with supply and demand.

In the child care centre industry, pricing is not something that is proactively or dynamically used to manage demand and occupancy because if we look at any geographic location the pricing of all the players is largely equivalent and even the quality of assets and programs is pretty much similar across all the players. The predominant differentiator and a major demand driver is location, on which Mr. Carroll noted (in the words to the effect of), “we are focussing on is how do we become the number one or two centre in any geographic location we are in because if the centre has a good local reputation its demand will still be high even when 5 or 6 new centres open up in that area. That’s our best strategic defence to any market cycle …we probably have over 100 centres that have hit that criteria now and our focus is on increasing that number and that could come through a combination of asset upgrade, standardised curriculum and quality of team. The other thing we need to do is to identify and divest centres that are in such a bad location that they can never get an amazing result, to improve overall occupancy and earnings.”

Capital structure.

The company’s Greenfield pipeline which was originally estimated around $200m, has been reduced by $35m due to ongoing negotiations with the developers. The company is working to refinance its Singapore notes worth $270m and the refinance comprises of $400m senior debt facilities and $100m junior facility and the Company expects its cost to be significantly lower than the existing cost of capital and improved covenant levels. GEM has seen more support from banks in terms of net debt to EBITDA covenants, which have been lifted to 3x from 2.3x previously, giving the company more headroom. Management thinks that net debt would increase over next several months because of the Greenfield pipeline and then de-lever quickly due to cashflow generation from the business. The business has good cash conversion ratio as most of the money comes from the government in form of subsidies.

Dividend payout.

The company has moved to a standard dividend structure, with 70%-80% of reported net profit being paid to the shareholders.