28 May 2019

Reach Markets publish the notes from our analyst meetings with company management. They should be read in conjunction with the research we’ve completed. Reach Markets endeavour to provide self-directed investors a seat at our investment meetings. We publish these notes in a conversational format to get these out as quickly as possible for your consumption.

We recently had a one-on-one meeting with James Inwood, Group Head of Stakeholder Relations of Goodman Group (GMG). The meeting was used as a refresher on the GMG story as well as to reassess our investment thoughts on the Company. Below are the key points from our discussion.

Lessons learnt from a tumultuous past.

Mr Inwood began by providing an overview of how GMG’s business model and how their focus has changed since the GFC. GMG’s model currently provides that they “do everything from buying raw land, taking it through planning, building it, managing it and then owning it for the long term… with everything done in house”, all enabled by the fact that “they are of scale in markets”.

This aspect of the model has not changed since the GFC, since they believe it is “the right model…we prefer to do everything directly with the customer, since we need control of the customer, we need to develop, own and manage…if you don’t understand the development equation, you don’t understand real estate value”.

Nonetheless, Mr Inwood noted that “there has been a big change in the last 6 to 7 years in terms of the real estate we own”, whereby they have already sold “40% of their original assets” which had “low barriers to entry…in slow rental growth areas” in order to achieve the “highest value per square metre logistics portfolio in the world by a factor of 50 to 100%.”

The biggest change he noted in their portfolio however, had come from the realisation during the GFC that “short term debt and long term real estate was not a good match”. Mr Inwood stated that GMG now has a longer term debt platform, where “essentially we don’t want anything we can’t source fund in the next 3 years in term of our financial liabilities… and while there is a cost to possibly paying for a 10 year facility when you’ve got a 7 year facility… we could argue that if you get caught with short term debt in the wrong part of the cycle, it costs far higher.”

By holding assets in tighter markets and being more selective in choosing properties, GMG’s “cashflow is fundamentally better than 10 years ago. We have been able to reposition ourselves to have no debt, little exposure to risk, change in the risk profile of the portfolio…since cash flow for all assets materially better… can now deploy capital when needed…”. Instead of “cap rates being the biggest driver of margins, rents are now the biggest driver of margin growth, which is fundamentally a better model.”

Threat of entry.

When asked about the threat of new players, Mr Inwood acknowledged that “we are not doing something that other cannot theoretically do.”, however stated that “not everyone has teams that have the local knowledge, experience and patience we do.”.

As noted above, their focus is on the long term, and consequently meant that GMG “can stomach a low yield for a few years to gain something more valuable a few years down the track… bring down our competitors to just a few.”

Although we brought up the issue of there being a natural demand on these key sites and a fundamental shift in players, Mr Inwood provided further colour with “many competitors fundamentally not set up to do it…they’re not factoring in risk…they’ll back local developers, they’ll do specs.”. He also mentioned that “a lot of this space in the market they’re buying up is space you don’t want to be in, because where they’re getting land is where you have no barriers to entry, because the land is abundant… and that’s where a lot of the money is currently going.”.

Mr Inwood also clarified to us that they were not 100% competing with the developers looking for infill locations, and that “because we understand the rental dynamic…our focus is on development of land over 3-4 years…[this strategy] being the best risk-to-return for us”.

Offshore market development

In line with GMG’s renewed focus on holding assets in tighter markets, “in China, we moved from 12 markets to 4, in the U.S. we’re focussed on just New Jersey and LA (their market growing at 4 to 5% per annum), in Europe 85% of our assets are in France, Germany and Poland.”

Investors must ask themselves however, whether or not this means that they are missing out on opportunities. Brazil is the only offshore market they called out where they have exposure where there are some downside risks: “we are very cautious about Brazil, but we are diversified with 5 partners and only a $40m position, so we’re not overly exposed”.

Asia and the U.S are likely to become larger components of the group, whilst Australia is likely see a relative decline. Ventures into India will be held off until markets and infrastructure mature further.

New IPO

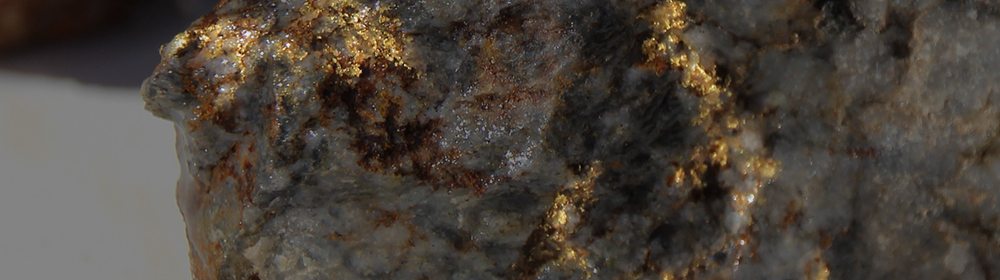

Gold explorer currently undergoing an IPO. Seeking fast track to production. Register to receive the prospectus upon approval.

Favourable market dynamics. When

When asked about the resilience of earnings, Mr Inwood stated that “for 5 years, it’s hard to see the environment changing…good visibility of earnings”. This is backed by the fact that “we are in a good environment… with demand totally off the stratosphere…I mean, especially in China…it’s boggling…”.

Whilst “logistics is fashionable right now…money is pouring in”, Mr Inwood said that “a lot of terrible real estate is being bought and people are generally still struggling to get real assets.” This demand can also be attributed to growing e-commerce, with “e-commerce flowing into retail the next wave of supply chain reconfiguration…the focus for big retailers being delivery and speed of delivery…big occupiers making investments into bulk facilities as close as they can [to stores]”. For instance, Mr Inwood gave the example that the Shanghai province is “not releasing anymore land for logistics real estate, but they need more space for it… their property maybe 6 years old, but they’ve already said they want us to go multi-storey… just shows the speed of growth and demand.”. This government restriction can also be seen in South Sydney, which has “negative industrial supply since there’s so much residential encroaching… and the thing also restricting supply is that the planning environment is very difficult…shortage of space as well”.

Asset management performance fee.

Mr Inwood emphasised that the performance fee was now a sustainable part of the business, and that “even if cap rates blew out 100bps” they still be in the money. These performance fees will grow in line with growth in AUM and inflation, and it is likely that there will be about “10-15% growth in AUM ($4.5-5bn), so you should be getting roughly 20% plus growth in FUM over the next 3 years…should be pretty achievable assuming development margins stay where they are…even if development performance fee are lost, the 6% [fixed fee] is still there.”