28 May 2019

Reach Markets publish the notes from our analyst meetings with company management. They should be read in conjunction with the research we’ve completed. Reach Markets endeavour to provide self-directed investors a seat at our investment meetings. We publish these notes in a conversational format to get these out as quickly as possible for your consumption.

We recently had a one-on-one meeting with Oil Search Ltd (OSH). The meeting was used as a refresher on the OSH story as well as to reassess our investment thoughts on the Company. Below are the key points from our discussion.

PNG Assets – post earthquake

The company’s CPF and HGCP gas production trains were forced to shut down temporarily in February 2018 after Papa New Guinea was hit by a 5 magnitude earthquake, which was very unexpected. However, all of OSH’s facilities and PNG LNG project facilities withstood the earthquake and after-shocks very well and came back online within 7 weeks despite being built to withstand an earthquake of 7 and since coming back online PNG LNG project has performed above pre-earthquake levels.

Most of OSH’s facilities were insured but its camps which suffered the greatest damage, were not insured and OSH had to spend a lot of money clearing the roads that were blocked by rockfalls, which in total was estimated at about $20m and that amount has already been incorporated into the company’s guidance for FY18. OSH also spent $10m on LNG cargo that was purchased to keep the trains cool to minimise the time it would take to fully comeback online and donated $5m to earthquake relief.

At the 1H18 results management upgraded the production post-earthquake to 24-26mboe (from 23-26mboe) and expects to achieve production at upper end of the range for the full year and expects to be back at full production levels by next year. PNG LNG is a conventional LNG project which means OSH does not need to drill any more wells to support the project, so the capex expenditure is very minimal (average $50-100m gross a year) over the life of the project, thus it adds additional value to the stakeholders without employing additional capex. The company noted, “we have identified a few opportunities for oil fields, to do more drilling to capture more oil…we are going to be producing a lot more gas from oil fields initially to support one of the three new trains and so we are quite keen to recover as much oil as we can before we produce the gas”.

The next phase.

The company noted, “we were looking at two train expansions for 8mt (similar trains to PNG LNG) but now it’s been recommended that we build 3, 2.7mt trains…two of them will be supplied by gas from the Elk-Antelope field and one of them will be supplied gas from the P’nyang field but will actually substitute that gas from the gas from existing PNG LNG project for the first maybe 4-5 years. What that does is reduces substantially the overall development costs that we need to spend upfront (estimated $12-13bn) to actually bring 3 new LNG trains (comprises of upstream expenditure, pipeline expenditure etc.), So if you compare that to the original developments cost that was $19bn, this is a materially lower upfront expenditure, so from a valuation perspective it is highly commercial value accretive project. We will also be utilising a lot of the existing infrastructure from PNG LNG plant site, Exxon Mobil will construct and operate the trains on behalf of the Papua LNG development and that means we can use the existing facilities there such as the jetty, construct only one LNG tank (even though we are doubling the amount of LNG being produced), use existing control room.

In total it will lead to $2-3bn in capital cost savings and $150m per annum in operating cost saving. Where we are in the process is that we are very far along with the technical aspects because Total is already operating in Antelope area so they are in charge of the technical aspects. There will be a central processing facility that would be affiliated to take out some of the impurities which are in the gas like H2 and benzene and then they will construct the pipeline along the same route as the existing PNG LNG project and down to the coast.”

New IPO

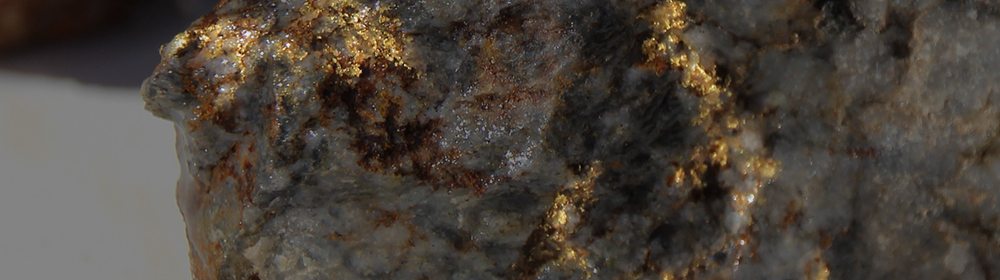

Gold explorer currently undergoing an IPO. Seeking fast track to production. Register to receive the prospectus upon approval.

OSH pushing to increase production before the surge in global supply.

U.S. production has started and it’s coming into the market but the sanctions might make it a little bit harder for the U.S. suppliers to cater the Asian market but as it becomes clear that there is going to be a shortfall of LNG in the market from early 2020, projects all around the world have started to come up like the massive LNG Canada project on which the company noted “we recognise that we want to move ahead with the production because of the number of other projects which are moving in. Qatar is obviously happening, and they are the lowest cost producers so all their volumes will be sold. Mozambique is likely to happen, but we think it’s going to take a bit longer than expected…we have still got 12-18 months before all that supply comes in because you still have the situation where lot of the new proposed projects struggle to make money. Once all the other projects start to move forward there is going to be more competition for the contractors”.

OSH’s critical path has nothing to do with technical aspects, marketing aspects or the financing aspects, it’s all about time taken to negotiate the agreements with the PNG government and the company has to negotiate two new agreements one for Elk-Antelope and other for P’nyang. The Company hopes to conclude these agreements by December 2018.

Alaska project – key things to watch out for.

OSH had a strategic review of the business and found out that in 5-10 years’ time its portfolio would be 90% gas focussed. 98% of the company’s assets are in PNG, which is a developing country so to de-risk their portfolio they searched for oil assets in more developed regions and assets which had materiality and room to grow. Another reason as to why OSH wants oil in its portfolio is because LNG is very long dated (takes about 10 years between sanctioning trains) and oil is generally very quick to market and expand.

The company has signed a deal with Armstrong Oil & Gas Inc, which is a very strong exploration company, on the pricing in July 2017, when the oil price was US$47/bbl. OSH has acquired interest in Pikka unit which is estimated to have 500mmboe but the company estimates the total production could rise to be 720-750mmboe on which the company noted, “we are planning to drill 2 infill wells and we will be using those wells to test our completion techniques which will be used to maximise the flow rates. In Alaska you can only drill during winter – the season is about 110 days so you have to be extremely organised to maximise the production. We are planning to build gravel roads which gives us 365 days access to the site. We expect we will drill the two wells between January and March and we expect to go into FEED in middle of next year which is a 12 month process so we will have a final investment decision in 2020 and then it would take 3 years for construction and we can expect first oil in 2023. We were previously looking at production of 80-120k bbl/day but we think now we will be on 120k bbl/day and that will be the initial production rate”.

The next level of focus for OSH would be appraisal and exploration of the Horseshoe area where there is potential for an extra 300mmboe, and that could lead to another CPF being constructed and adding on additional 120k bbl/day. Since the company bought the asset there has already been a lot of value creation in term of the oil price recovery and the U.S. tax reforms (which added US$150m to the NPV). OSH would be funding 60%-70% of the project through debt and balance through equity. We think a great value addition to the project is the option that gives OSH the right to double its interest on top of current 25.5% stake in Pikka unit and 27.5% stake in Horseshoe, and buy out the rest of Nanushuk reservoir for $450m and now that the value of the asset has appreciated it is very likely that OSH would exercise the option.