21 January 2026

Time to review 2020 and prognosticate on 2021. Around this time last year we wrote a piece titled “2019 A Surprisingly Good Year for Risk Assets: 2020 Outlook,” time to do it all again. The cautious stance looked ok, even before Covid-19 kicked in and reduced the global economy to an effective standstill. Our stance on Japan was positive and we continued to bemoan the lack of incentives on the fiscal side and we wanted the cessation of the ‘monetary policy for rich people’ aka Zero Interest Rate Policy.

This article was originally published on TAMIM. Reach Markets has permission from the author to publish it. The views and opinions expressed in this article are those of the author and do not necessarily reflect the views and opinions of Reach Markets.

Time to review 2020 and prognosticate on 2021. Around this time last year we wrote a piece titled “2019 A Surprisingly Good Year for Risk Assets: 2020 Outlook,” time to do it all again.

The cautious stance looked ok, even before Covid-19 kicked in and reduced the global economy to an effective standstill. Our stance on Japan was positive and we continued to bemoan the lack of incentives on the fiscal side and we wanted the cessation of the ‘monetary policy for rich people’ aka Zero Interest Rate Policy. Someone might be listening because we now have a plethora of fiscal incentives being discussed, which should (finally) help to improve productivity and growth potential on a sustainable basis. Check out the (lack of) GDP per capita growth in most Western style economies if you believe ZIRP has produced anything other than a reflated asset souffle; and MUCH more debt risk.

Speaking of debts. The COVID-19 response has shovelled more debt onto future generations. This can’t be paid back, shouldn’t be paid back, and so won’t be paid back. Currently inflation is everyone’s good idea (not ours) of the way to deal with this overhang. Let’s just say that:- it’s risible that policy makers believe that exactly the right amount of inflation can be created; that it will inflate away the value of debts to the benefit of only the most deserving indebted; and that it can immediately be bottled up when the correct amount of debt destruction has been reached.

If there is too much debt (and there is) and you think that some segments of society deserve a reprieve then a MUCH BETTER WAY is to have focused debt forgiveness and write it off. The incoming (?) Biden administration is examining writing off significant amounts of student debt. We would also politely suggest that the Virtue Signaling ‘Tech Luvvies’ might also think about having their companies pay some tax? We see that Mr Musk has moved to Texas because of the apparent “lack of support for tech industries now in California”.

Hah- Oh yeah? Nothing to do with significant differences in state tax and their likely trajectories then? A dirty little secret of the Trump administration is that he RAISED taxes significantly through reductions in offset allowances between state and federal filings. This hit the Democrat states hardest and the population shift South and East in the USA is quite remarkable.

2020 was ok and the best thing we did was to not panic in April and remain invested. It’s our investment philosophy that timing markets, risk factors and style shifts is difficult and dangerous.

So, what do we make of 2021? Here’s some thoughts and they are brief because we know everyone has a crystal ball out at the moment. However, ours ARE definitely 100% correct.*

- Japan becomes a more popular investment destination. The market continues a multi-year re-rating. It’s been a stealth bull market in Japan and most Australian based ‘global’ fund managers don’t know where it is let alone what’s happening there. We frankly don’t mind too much with whom you invest there but invest there you should. Now. Under-owned, undervalued, underleveraged, underappreciated.

- National Industrial Policy continues to be expanded. It started a year or two back and when President Trump invoked the 1950 Defense Procurement Act, to force the likes of 3M and GM to produce ventilators and face-masks it was ‘game-on’. Europe has been trying (with not much success) for a few years and China has acknowledged it is about as popular globally as a rattlesnake in a lucky dip, so is becoming less reliant on USA tech, and more explicitly favouring self-reliance – namely Made in China 2025. This has positive implications for supply chain companies (We like Kerry Logistics for example) R&D, and corporate fiscal spending. Transport stocks are quite intriguing which leads us onto…

- Renewal of capital stock. The USA is a first world country with third world infrastructure. Just possibly the chastening experience of Pelosi + Schumer vs McConnell + McCarthy might result in more constructive dialogue to address this? As in Republicans + Democrats executing ‘Build Back Better’ (formerly known as ‘Make America Great Again’) As a certain W Churchill once said, the USA invariably does the right thing but only after exhausting all other possibilities. We manage a global infrastructure strategy and are looking into launch a fund, investing in global infrastructure companies, imminently. These stocks are reasonably priced, there is a lot of technology they own and implement, and the renewals theme isn’t going away. One of our holdings, NextEra Energy (see chart below), has performed pretty well. There are plenty others out there and more to be created. Invest in infrastructure spending beneficiaries. We have.

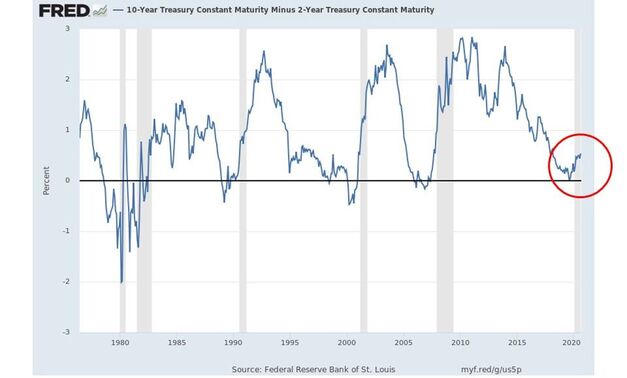

- The USA yield curve continues to steepen AND investors finally notice. Anyone who has listened or watched AusbizTV on Friday mornings may have heard us continually state that the yield curve is steepening; that the recent Jackson Hole speech by Governor Powell explicitly said nothing about Yield Curve Containment; and that a steepening yield curve has in the past changed the leadership of the equity market. Value over growth, cyclicals over staples, that sort of thing. Now while we fully understand that the yield curve has been kept at zero and flat out to 10 years for a while and that has changed the relationships between cost of capital for equities and investor preferences for dividends, it is very unlikely that normal service won’t be resumed; meaning watch out if you own a bunch of junk with highly questionable growth prospects, aggressive accounting and promotional management. See the trend in the shape of the yield curve below.

- Asia becomes an investment powerhouse, politicians get on much better with each other and the markets remove the discount for the Chinese invasion. Mercantilism essentially always triumphs political purity in Asia. The new Prime Minister in Japan, Suga-san is more acceptable than his predecessors, to Asian countries for a number of reasons. His visits to Vietnam and calls to India are not accidental. China knows that there has to be some retreat from its overly aggressive stance. It will be back to ‘business as usual’ we believe, which means a lot of political posturing but a lot of intra- regional FDI and cooperation. You can choose to listen to the politicians or follow the money. We know what we do.

Click here to join our next ‘The Insider: Meet the Fund Manager’ session, a FREE webcast series gives you direct access to prominent fund managers who share their “Insider” views on their top stock picks that they think have the greatest upside.

Past performance is not a reliable indicator of future performance.