21 January 2026

Australian big data company Xsights has managed what most tech companies dream of: the potential to sign contracts worth $100s million ARR with companies worth $100s billion, driven mostly by inbound demand.

Australian big data company Xsights has managed what most tech companies dream of: the potential to sign contracts worth $100s million ARR with companies worth $100s billion, driven mostly by inbound demand.

Call it foresight or luck – the industry giants in the $300bn pork industry want to talk to them as the leading company to take them from the stone age to big data – with the potential for some large operators to save $1bn+ every year.

This year unprecedented traction has seen Xsights going from first introduction to paid trials in only weeks, talks and trials with 5 of the top 10 global industry players and a pipeline surging to nearly $940 million in recurring revenue opportunity.

The strategy now is straightforward: to move as many of these opportunities forward, targeting a $1bn+ exit to one of the industry heavyweights.

“This is a market dominated by giants. The kind of rare traction we are getting and the fact that we are receiving inbound interest and converting to paid trials after just one meeting has taken me by surprise and exceeded my most optimistic expectation.” said Steve Wildisen, Co-Founder and CEO.

Reach Markets will soon be opening a capital raise for Xsights to fund their global commercial scale-up within a $300 billion market. This is a unique opportunity to invest in a senior-ranking preferred share structure offering full upside, but also with strong downside protection.

Click here to join an upcoming webcast with Xsights with Co-Founder and CEO Steve Wildisen.

Right place at the right time: Transforming the pork industry

The Xsights story is a classic one of being in the right place at the right time, which started in 2021 with an experienced team working to develop smart asset tracking technology with multiple potential applications.

In 2022, they discovered massive inefficiencies in the $300 billion pork industry which is plagued by $50 billion in annual losses due to outdated, inefficient practices. The sector had seen little real innovation in over 40 years leading to high pig mortality, excessive medication, theft and undetected epidemics – all made worse by a dwindling skilled workforce.

Sensing a unique opportunity for producers to potentially save billions, the team decided to focus all efforts on this problem.

Over the next two years, the “Fitbit for pigs” started to get noticed. They won major industry awards, government support and fielded inbound requests from global operators including some of the largest on the planet.

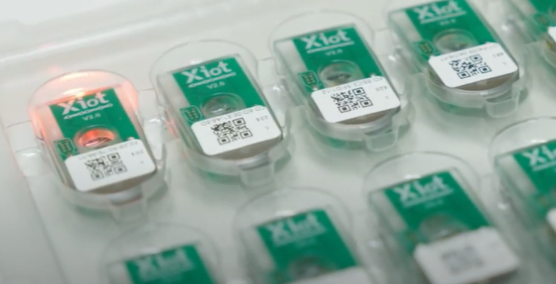

Xsights XioT Ear Tag (Source: Xsights)

After rolling out the first commercial scale contract with Australia’s 3rd largest pork producer last year, the pace and scale of international interest quickly prompted Xsights to focus on global expansion, as inbound requests surged at a rate rarely seen in the tech sector.

And now in 2025, the speed and impact of adoption has even taken industry veterans by surprise.

Click here to join a webcast with Xsights Co-Founder and CEO Steve Wildisen, where he will explain how their big data/machine learning technology helps producers potentially save billions every year.

Industry Giants Take Notice as Xsights Delivers

Xsights’ traction in 2025 has been nothing short of extraordinary. Talking, or in trial, with 5 of the 10 top producers in the world, building a pipeline of $800 million potential recurring revenue by Q1, they have now grown from three to 12 paid trials in just four months with additional growth taking their pipeline to around $940 million at the start of Q3. They anticipate this figure to more than double again by year-end, targeting 30 trials.

This extraordinary rate of engagement, especially in a sector which is so closed off to the outside world, highlights Xsights’ global relevance in assisting the industry to shift toward big data and AI for potential adopters and acquirers.

Among these are CP Foods (CPF), an equivalent to Microsoft in the agri-food world, and a powerhouse within Thailand’s CP Group conglomerate, the country’s largest corporation, with annual revenues exceeding $150 billion. Its pork operations alone process 35 million pigs a year, worth over $12 billion in sales.

Xsights already has five trial farms committed with CPF. Trials at other operators have shown that savings from mortality reduction alone has the potential to increase revenue by 15% and could double the bottom line. Even if half of this is achieved at CP’s scale the savings could be over $1bn. This raises the question as to why CP wouldn’t just buy Xsights.

The 26-storey pig farm in Ezhou, Hubei province, China (Source: South China Morning Post)

The industry has never seen a company move from initial introduction to trials at the pace Xsights did with CPF, which is even more noteworthy when considering that CPF is the Google or Microsoft of this industry. The first trials have been highly successful and were the catalyst for CPF’s China operations to immediately launch four trials sites themselves.

Even governments are acting: the Thai ambassador personally visiting to promise 50% technology subsidies for Thai operators, visible proof of market demand.

With this momentum, Xsights’ focus now shifts to leveraging these relationships for an exit opportunity.

The hottest commodity in agriculture tech

With CPF alone, Steve and the team have the potential for a $200 million ARR opportunity, but that is not the real goal. The strategy is to attract as many large operators as possible with the company’s sights set on an early billion dollar plus exit to one of these operators.

One candidate is agriculture giant Cargill, who supplies the world’s farming operators with feed and other materials. Cargill could include Xsights’ solutions in its product offering.

At over $250bn annual revenue, Cargill could bolt-on Xsights rather than dealing with it as a partner. Equally, large pig operators, who compete fiercely with each other for market share, might aim to buy Xsights to own the solution exclusively.

Whoever owns the platform could roll it out at scale, achieving massive cost savings and operational efficiencies and, if they wanted to, effectively lock out competitors from accessing the same advantages.

“I’m pinching myself every day. Everything seems to be falling into place for us right now. We’re in the right place at the right time, and it’s hard not to get excited about the path ahead.” said Steve Wildisen, Co-Founder and CEO.

Join us for an upcoming Live Investor Briefing where Steve Wildisen, Co-Founder and CEO of Xsights, will explain his solution which has unprecedented traction from some of the world’s largest operators. Click here to book your spot.

Reach Markets provide Corporate Advisory Services to Xsights Digital Pty Ltd and will receive fees for its role in managing this offer based on the uptake by investors.

Reach Investment Group Nominees Pty Ltd ATF R Markets Unit Trust, a related entity of Reach Markets, holds shares in Xsights Digital Pty Ltd.