28 May 2019

Reach Markets publish the notes from our analyst meetings with company management. They should be read in conjunction with the research we’ve completed. Reach Markets endeavour to provide self-directed investors a seat at our investment meetings. We publish these notes in a conversational format to get these out as quickly as possible for your consumption.

We recently had a one-on-one meeting with Mark Wilterding, Director of Investor Relations of Medtronic Plc (MDT). MDT is an innovative medical technology, services and solutions company operating in four segments (Cardiac & Vascular, Minimally Invasive Therapies, Restorative Therapies and Diabetes). The meeting was used to reassess our investment thoughts on the Company. Below are the key points from our discussion.

Revenue growth:

MDT changed its forecasts for revenue growth in June 2018 to 4% organic revenue growth (long term) from previous goal of double-digits earnings growth and mid-single digits revenue growth. The company is also targeting 8% adjusted EPS growth over the next 5-year period and has shown really good progress on execution side of things as they are now close to 3 consecutive quarters of 6.5% organic revenue growth, but the management team does not anticipate that to last forever. Management has a focus on the pipeline and have got the strongest pipeline in the history of the company currently, which is driving the 6.5% revenue growth. The company has got some good product launches due in the course of next 18 months, which should sustain its long-term target of 4% organic revenue growth. The company has pledged to grow its diabetes segment well above the corporate average going forward.

Emerging markets opportunity:

EM is the largest growth driver opportunity for the company, accounting for 15% of the total sales and growing rapidly overtime. The company has demonstrated the ability to grow consistently in the double-digit range in any given quarter or year in EM. China today accounts for 40% of MDT’s total EM revenue and is the single largest portion of its EM business. MDT’s emerging markets portfolio is diversified and has 20% sales coming from Middle east and Africa, 20% from Latin America, 40% from China and rest from other emerging countries on which Mr. Wilterding noted (in the words to the effect of), “we have shown that it works in our advantage in cases where for instance like Middle East about 2 years ago had a little bit of issue in Saudi Arabia and as a whole our EM business was able to cope with that issue…we have diversified it enough so that if there are issues in a particular region we should be able to balance that our with some other areas”.

The company’s market leading technology has helped increase the adoption of its products in emerging markets. Moreover, the company has also seen a great willingness on behalf of the government in these countries to partner with them to come up with solutions that can help manage their population in cases of chronic diseases like diabetes, obesity etc. In China, MDT has narrowed down the number of distributors and attempt to go more direct to the end user. In China, the company targets only the premium customers which pay out of their pocket and don’t have an issue of pricing but going forward as MDT broadens its distribution and targets other classes of patients they would consider pricing sensitivity. The company’s margin profile and pricing in the non-US countries including the EM is consistent.

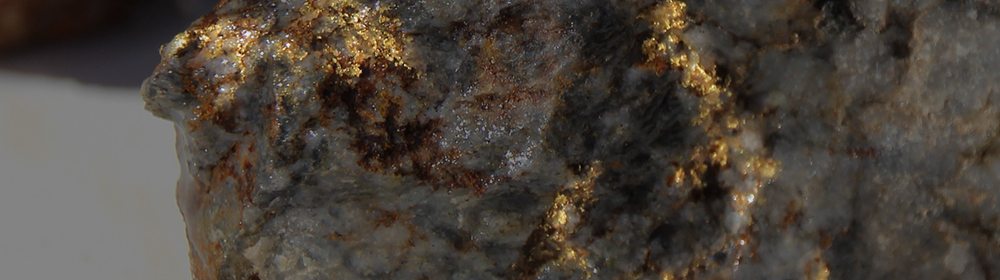

New IPO

Gold explorer currently undergoing an IPO. Seeking fast track to production. Register to receive the prospectus upon approval.

Opportunity in Diabetes segment.

The Diabetes segment although the smallest operating unit in the Company (representing only ~6-7% of group revenue), is anticipating double-digit growth in FY19. MDT also commented on in its market leadership in the Diabetes space, praising the recent FDA approved insulin pump system as the segment’s pathway to global relevance and expansion. The Diabetes segment is Medtronic’s up-and-rising growth story alongside EM, and we are similarly confident that the Company will be able to capitalize and deliver on its double-digit guidance going into FY19.

U.S. – China trade war’s effect on MDT:

The company is taking into account the proposed tariff increases but at this point they don’t anticipate any material impact to the business on which Mr. Wilterding noted (in the words to the effect of), “it is obviously something we are monitoring closely…we don’t manufacture a lot of products in China itself but a lot of the products are imported from other regions (not necessarily in the U.S.)…we have a large manufacturing presence in areas like Switzerland, Puerto Rico and Singapore, so it doesn’t completely shield us from risk but we should be able to mitigate some of those headwinds”.

Margin expansion (40-50bps):

The majority of the margin expansion can be attributed to the enterprise excellence initiatives that the company rolled out earlier this fiscal year, which could be broken up into 3 buckets and include; the global operations, the functional optimization and the commercial optimisation on which Mr. Wilterding noted (in the words to the effect of), “the global operations is majority of what we anticipate will drive the margin expansion…it is to integrate and evolve global operations to improve quality of cost and cash flow…for example if we take a look across our manufacturing footprint, today we have ~75 global operation manufacturing sites and we would bring them down to 55…so its network optimization, consolidation of that manufacturing footprint and leveraging the contract manufacturing…if you bucket amongst those three categories where majority of that 40-50bps comes from its from a global operations perspective and we are in the early innings of working through that but it would take another year or two before you start seeing real benefit of it”.

Covidien acquisition:

In January 2018, MDT announced the completion of $850m cost savings from the acquisition of Covidien. Mr. Wilterding noted in the words to the effect of, “we are very pleased with how the integration of Covidien has gone and continues to go as it was the largest acquisition in company’s history and I think from day one the aim was to preserve the growth profile of the two individual companies and then overtime optimize and accelerate that growth profile…we are very pleased from the revenue growth perspective in terms how it has opened the doors to some of the emerging markets …from an earnings perspective we are disappointed and I think the issue was the forex headwinds and Covidien didn’t have a hedging program in place so when we acquired them it was tough timing (the dollar appreciated significantly) and as a result we had a pretty significant forex headwind to deal with right around the time the deal closed and so it did dampen our earnings potential from a consolidated company perspective and that also flowed to our FCF…prior to the acquisition we thought that the company has the potential to generate $40bn in cumulative FCF for the course of 5 years after the closing of the transaction…fast forward now, 3 years after the completion of the deal we are falling short of that target…we did only $4bn of FCF in FY18”. Now the company has a hedging program in place so going forward forex should not be a headwind on the revenue line.

Capital management:

Wilterding noted in the words to the effect of, “in terms of capital allocation we said that a minimum of 50% is returned to shareholders primarily in the form of the dividend…our payout ratio now is in excess of 40%, which translates to $2 a share and a yield of over 2% and our focus is to maintain that…in terms of share repurchase at a minimum we purchase to offset the dilution associated with stock options and beyond that we have said that if it makes sense we would opportunistically repurchase shares as well if it is to the benefit of the shareholders…in terms of capital allocation the priority becomes investment in M&A and then the last on the list is debt paydown…we are at a point where we think we are comfortable with our leverage ratio and we have an A credit rating and we think we can maintain that…our current leverage ratio is sufficient to maintain the A credit rating…there is still room for acquisitions and our focus will be on bolt-on and tuck-in acquisitions”.

R&D expenditure:

The company currently has a target to spend 7.5% of total sale annually on R&D expenditure and we think MDT is among the best in the business in terms of identifying new technologies and therapies and bringing them to market on which Mr. Wilterding noted (in the words to the effect of), “we think the return on internal investment on R&D is better than the return on M&A and we will continue to invest more money internally”.