28 May 2019

Reach Markets publish the notes from our analyst meetings with company management. They should be read in conjunction with the research we’ve completed. Reach Markets endeavour to provide self-directed investors a seat at our investment meetings. We publish these notes in a conversational format to get these out as quickly as possible for your consumption.

We recently had a one-on-one meeting with Orocobre Ltd (ORE). The meeting was used as a refresher on the ORE story as well as to reassess our investment thoughts on the Company. Below are the key points from our discussion.

- Management is starting to feel more comfortable how the operations are now running, with the Company producing the best results operationally during the last quarter despite seasonal drag.

- The Company is fully funded for stage 2 at Olaroz and Lithium Hydroxide plant in Japan, hence the Company has no need to come to the market to raise new money. Further, with cash flows from operations and existing cash, the Company is also likely to be well placed for stage 3 at Olaroz.

Bluesky production

Management believes production at Olaroz could potentially (speaking bluesky) increase to 100,000tpa (and higher) (stage 2 expansion will increase carbonate production to 42,500tpa). The bluesky opportunity is premised on the fact that the 6.4 million tonnes of resources are only on the small part of the basin calculated at depths of 200 metres, with drilling results noting it can go down to 500-600 metres. Further the Company has not drilled the full lateral opportunities (North and South areas). Management continues to work on these opportunities to determine what amount of production they should be aiming for.

Whilst bluesky opportunities are great, the Company is focused on getting stage 1 right operationally before they expect the market to place any value on stage 2 and beyond in ORE’s share price.

Argentina concerns

The Company spoke about the investor concerns of operating in Argentina in the current climate with currency devaluation and inflation risks. Management believes they have extensive experience operating in Argentina and have found that inflation & currency devaluation map each over the long-run. The Company remains comfortable with the challenges that come with operating in Argentina. The recent Argentina and emerging markets volatility in global markets has also seen downward pressure in ORE’s share price.

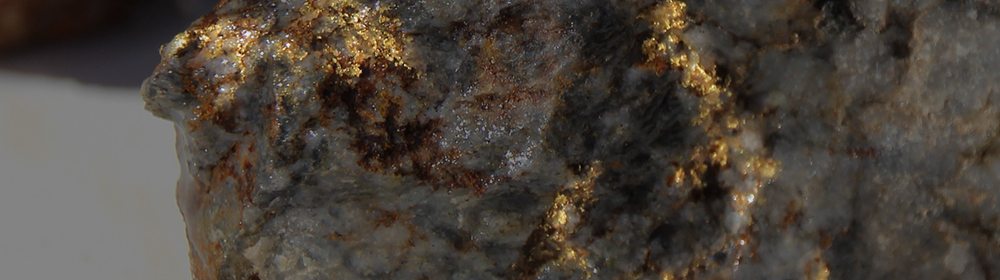

New IPO

Gold explorer currently undergoing an IPO. Seeking fast track to production. Register to receive the prospectus upon approval.

Removing seasonality

The Company has already started to put in ponds for stage 2, that is putting in extra capacity into the system to deliver more consistency into the plant throughout the year. This is critical to mitigating previous issues experienced with ponds – that is putting in more ponds per annual production of tonnes versus first stage. This will provide a buffer against bad weather and winter periods. The Company is also looking to add more evaporators inside the plant to keep the concentration levels up and production levels up.

Weakness in Chinese spot prices

Overall, the Company cautioned looking at the Chinese spot price as a reference for the broader market given it is a very small component of the overall Lithium market. Bulk of the volume is transacted in the contracted market with existing, long-term relationships. Changing supplier requires due diligence and qualification process (can take 6 – 9 months), hence it is not a straight forward process. However, the recent drivers of weakness in Chinese spot prices means:

1. low quality supply found its way back into the spot market after it was rejected by cathode manufacturers;

2. some China based brine production also ended back into the spot market; and

3. there has been a lag in demand from some battery manufacturers but are starting to see these guys come back on. There appears to be demand sitting on the sidelines hoping to buy at a cheaper price however some of the cathode manufacturers are reporting significant increases in their order books (+50-60% change) and hence they will need to come back into the market to purchase raw material. Therefore, the Company expects a rally in spot prices leading into the end of the year driven by demand (also assisted by seasonal demand).

Recent change in CEO

Previous CEO Richard Seville has been involved since day one and getting the Company up to this point. Along with taking a break from a high demand corporate role, he also believes it is the right time to pass the Company to a new set of hand for its next leg of growth – someone with a more operational focus and skillset. That is, the new CEO has to deliver on the stated strategy and building the current assets. We note the previous CEO Richard built a very strong and open culture and the Board expects the new CEO Martin Perez de Solay to maintain this culture.