4 July 2025

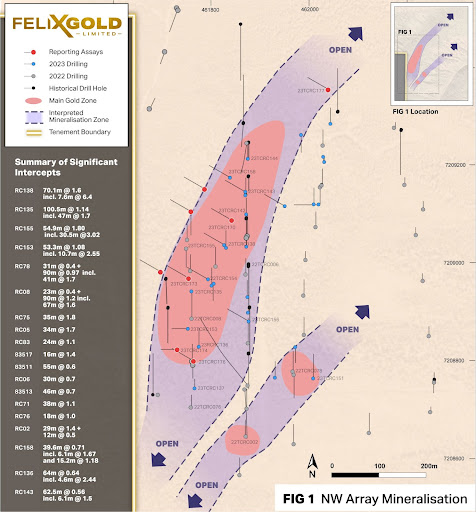

Another week, another round of assays for Felix Gold Ltd (ASX: FXG). The company has released gold and antimony findings from the final 17 holes from their flagship NW Array project in Alaska, where a maiden mineral resource estimate is due to be declared later this year.

Another week, another round of assays for Felix Gold Ltd (ASX: FXG). The company has released gold and antimony findings from the final 17 holes from their flagship NW Array project in Alaska, where a maiden mineral resource estimate is due to be declared later this year.

The additional information this part of the campaign provided has facilitated a geological reinterpretation of drilling information that has outlined a north-northeast orientation of mineralised gold zones – that are enriched with high grade antimony.

The development represents a significant milestone because it increases what is already a large strike length, while raising the prospect of additional parallel trends that could be just as full of precious metals as the current area being drilled is. This notion is supported by the continuation of soil anomalies.

Join an investor briefing with Anthony Reilly, MD of Felix Gold, at 1pm (AEST) this Thursday 17th August to hear more. Click here to book in.

Felix’s drilling strategy is oriented towards the definition of near-surface oxide gold mineralisation, with a focus on attaining grades that are comparable to or exceed the present head grades of the nearby Kinross’s Fort Knox mine, which is actively pursuing ore supply.

Fort Knox has a 16Mtpa mill that is operating at just 55% of capacity and receives a head grade of around 0.7g/t Au.

Image: Felix Gold NW Array Mineralisation.

This week’s assays mark the end of infill drilling for the time being, with a total of 45 holes drilled and results received. A few standout ones include: 9.1m @ 1.18g/t Au from 96m incl. 3.0m @ 2.16g/t Au from 96m, 12.2m @ 0.75g/t Au from 58m incl. 3.0m @ 2.39g/t Au from 65.5m and 21.3m @ 0.72g/t Au from 3.0m incl. 6.1m @ 1.67g/t Au from 15.2m.

This assay came back with the targeted amount of gold but also returned a brilliant grade of antimony, coming in at 32.0m @ 0.69g/t Au from 3.0m with 1.5m @ >5% Sb from 6.1m incl. 4.6m @ 3.13g/t Au from 3.0m and 1.5m @ 2.03% Sb from 7.6m.

There are still 5 assays pending from target generation drilling in the Scrafford extension area, which will lay the ground for a subsequent drilling campaign that Felix is excited to get stuck into.

These results build on the Alaskan gold explorer’s results released earlier last week, which included 54.9m @ 1.80g/t Au from 1.5m, including 30.5m @3.02g/t Au from 7.6m and 4.6m @ 7.10g/t Au from 19.8m. The company also intercepted 53.3m @ 1.08g/t Au from 30.5m including 10.7m @ 2.55g/t Au from 44.2m.

Both the grade and the near surface nature of the mineralisation indicate a potential low cost open-pitable resource. The area they have been drilling, NW Array Southern Zone, has the potential to host from 270koz to 890koz gold – which they believe is more than enough to get their neighbours to the negotiating table.

Join an investor briefing with Anthony Reilly, MD of Felix Gold, at 1pm (AEST) this Thursday 17th August to learn more. Click here to book in.

Reach Corporate provides Corporate Advisory Services, including managing investor communications on behalf of Felix Gold Limited and may receive fees for its services.

Past performance is not a reliable indicator of future performance.