21 January 2026

How this ASX listed company is positioned in the multi-billion critical minerals boom

ASX listed company Advanced Energy Minerals (AEM) is positioned to capitalise on the supply gap in the High-Purity Alumina (HPA) market. Operating one of only two plants globally that can produce 5N-grade HPA – the highest quality grade possible – they are targeting ~US$60 million annual EBITDA at full production capacity as demand from AI data centers, semiconductors, and EV batteries surges.

AEM produces High-Purity Alumina (HPA) – an essential component for high-tech products like semiconductors, LEDs, medical devices and Li-ion and solid state batteries. Demand is surging, with the market anticipated to grow 2.5x to US$4 billion by 2035, but supply is limited – which is one reason why it’s on Australia’s critical minerals list.

The company owns a fully operational production plant in Quebec, Canada, with over AU$350m already invested. Its current 2,000 tpa capacity is expanding to 3,000 tpa this year, targeting circa AU$100m annual revenue at industry-leading margins of 70%+.

AEM successfully completed its ASX IPO on 24 December 2025, raising ~AU$44.8 million at AU$0.53 per share for a market capitalisation of AU$312 million. With a customer pipeline of over 4,800 tpa already secured – far exceeding current production capacity, the company is in a good position to potentially achieve cash flow break even during 2026.

Richard Seville has been leading the company as Executive Chairman. He is well known for leading lithium producer Orocobre from its AU$7m float to a AU$4bn+ exit, which gives him significant experience in taking global minerals projects all the way.

High-Purity Alumina – essential for fast-growing technologies

High-Purity Alumina (HPA) is a critical material for rapidly growing technologies, offering capabilities that significantly outperform alternative materials.

It is highly conductive – over 25x higher than that of incumbent high-purity silica. It has an extremely high melting point of over 2000 degrees celsius, which is higher than platinum. Additionally, it is one of the hardest known materials on the planet – rating 9 out of 10 on the Mohs scale, only second to diamond – making it extremely scratch resistant compared to traditional alumina.

High-Purity Alumina (Source: Adobe Stock)

There are a number of use cases for high purity alumina including semiconductors, ceramics in medical devices, lithium-ion and solid state batteries, and LEDs. But one specific example is the increasing demand for semiconductors in AI data centers.

AI’s growing processing power demands increased electricity use, leading to significant heating. Cooling accounts for 40% of AI data center energy use and could consume ~1.5% of global electricity by 2030. Highly conductive materials like high purity alumina – with 25x better conductivity than the current options – are crucial for efficient heat dissipation, improving performance and reducing energy costs.

As a key component of lithium-ion batteries, HPA-coated separators are used to improve the battery’s overall stability, safety and performance durability. It works to separate the positive and negative components of the battery and prevent short-circuiting – ultimately preventing the battery from exploding.

The supply of high purity alumina is already squeezed, and users are worrying about where their future supply is coming from. The high purity alumina market alone is anticipated to grow at a 10% CAGR to ~US$4 billion by 2035.

The high-purity alumina market is facing a supply squeeze, driven by the rapid growth of sector-specific markets. The Micro-LED sector, valued at US$623 million in 2023, is anticipated to grow at a staggering CAGR of 77% from 2024 to 2030, fueled by the rising demand for screens capable of displaying detailed graphics for on-demand content.

With strong demand for electric vehicles, EV battery demand rises in parallel, experiencing a 65% surge. Additionally, the global semiconductor market, worth US$607 billion in 2024, is projected to reach US$980 billion by 2029, further driving demand for HPA.

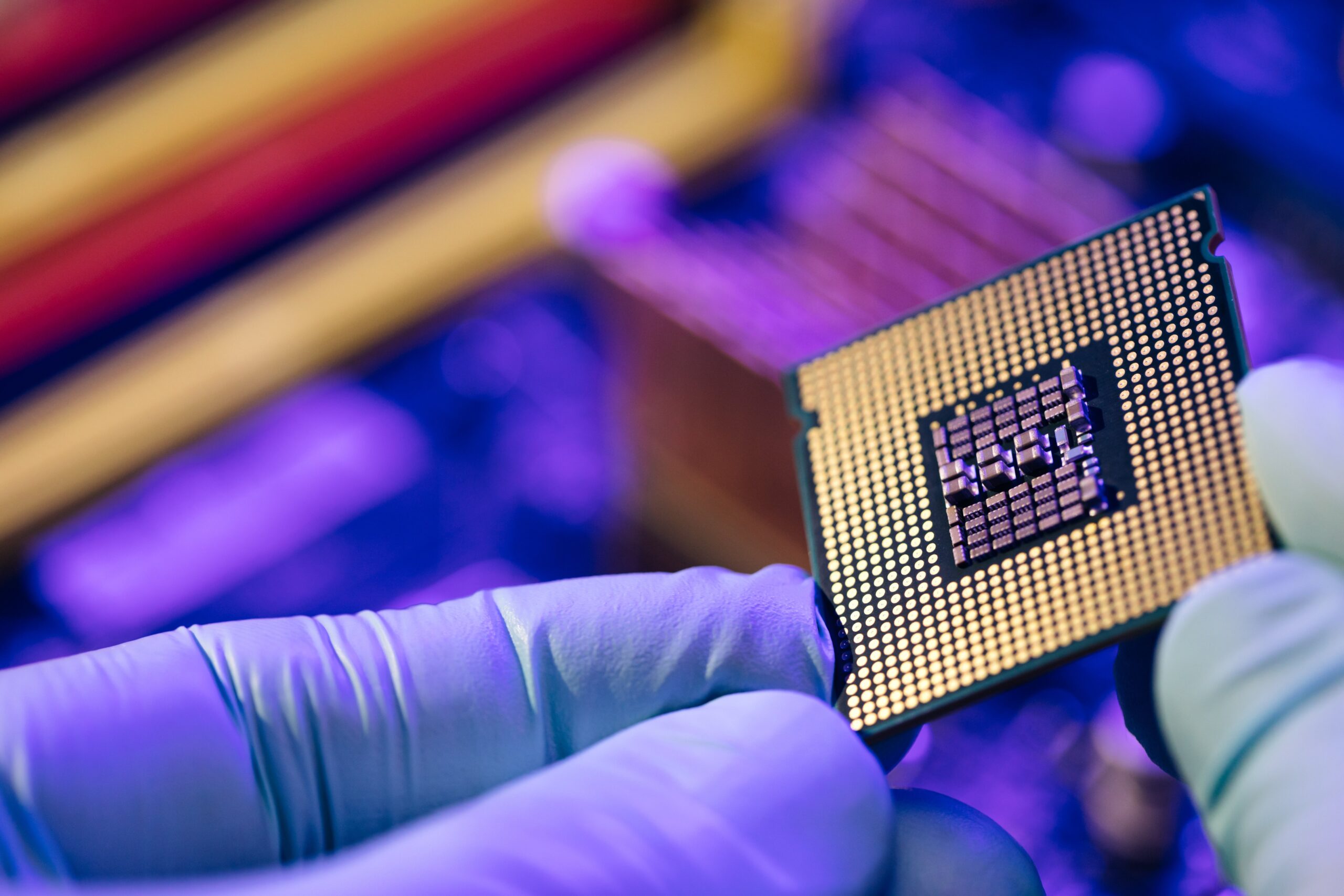

Semiconductors – a key sector for the use of high purity alumina (Source: Adobe Stock)

Becoming a high purity alumina supplier is extremely difficult. It is a very tricky production process to get right, and a plant requires hundreds of millions of dollars and years of planning and construction. As an example, the current ASX-listed Alpha HPA’s production facility is anticipated to take approximately another two years to build.

The global high purity alumina market is a highly concentrated market, with China controlling almost half of global supply – which is why it is on the Australian and Canadian critical minerals list.

There is a genuine concern about a supply gap which is putting producers in a powerful position.

How the opportunity for AEM came about

AEM’s production plant in Quebec, Canada, was originally built by Orbite who had invested over AU$300m into the CapChat plant, laboratory and patents. However, Orbite selected the wrong equipment which led to a failure in production and eventually running out of money.

AEM’s Cap Chat Plant (Source: AEM)

A group of investors purchased these assets out of administration in 2020, and brought in a high-profile team, which includes the current Executive Chairman, Richard Seville, who is known for taking Orocobre – a lithium producer – from a AU$7 million IPO to over AU$4 billion as CEO. Richard built relationships with Japanese companies such as Toyota and Mizuhu, which are very relevant in this sector.

There was a further AU$85m investment into the plant since the current team took over – with a significant portion contributed by the board themselves.

The company was recently listed at a starting market cap of AU$312m, raising AU$44.8m and significantly oversubscribed by Cannacord and Ord Minnet.

Since 2021, AEM has successfully been producing on specification HPA for engineering optimisation and product qualification. In 2023, a capital works program commenced to deliver a commercial scale operation and it is just about to commence commissioning of the upgraded circuits.

AEM’s growth strategy

AEM’s is one of just two known High Purity Alumina plants in the world that are capable of producing 5N – the highest quality grade possible – and are already in the production stage. With their patented hydrometallurgical CLCP process, and low cost energy at <US5c/KWhr they are anticipated to potentially be one of the lowest-cost producers of 4N HPA globally and deliver exceptionally high margins.

With Richard Seville leading the charge, his experience with taking projects all the way to production and his relationships with multi-nationals such as Toyota, provides AEM the ability to ramp up their commercial clients and become a key supplier to the high purity alumina market.

AEM Executive Chairman – Richard Seville (Source: AEM)

AEM has been producing high purity alumina for four years, with market engagement and qualification purposes and delivered a commercial scale plant of 2,000 tpa last year, with expansion to 3,000 tpa capacity anticipated this year through the addition of a dedicated 3N5 circuit.

With 12 customers already qualified and 140 going through qualification, representing a pipeline of 4,800tpa AEM believes it has the potential to achieve cashflow breakeven during 2026 with a full production at the end of two years and are targeting an EBITDA run rate of ~US$60 million per year. These cash flows, expected debt package plus the recent IPO, will help fund the Stage 2 expansion to double capacity to 6,000 tpa, with initial works to start in 2027 and production beginning Q2 2029.

The Stage 2 PFS (completed in June 2025) indicates steady-state EBITDA of US$47–85 million p.a. at margins of 74–84%.

AEM has developed a robust customer pipeline of over 4,800 tpa across 140 qualification projects, with 12 customers in commercial engagement stage (representing 700 tpa) and three framework agreements already secured. Market pricing for 4N+ HPA is projected at US$32.5/kg in 2026, positioning AEM’s low-cost production with Stage 2 expansion projecting industry-leading gross margins exceeding 70%.

Alpha HPA, with a market cap of over AU$1 billion, is currently under construction for a production plant which they aim to complete by FY28 – making AEM the only current high purity alumina producer on the ASX.

Reach Markets have been engaged by Advanced Energy Minerals Ltd and may receive fees for its services.