28 May 2019

Reach Markets publish the notes from our analyst meetings with company management. They should be read in conjunction with the research we’ve completed. Reach Markets endeavour to provide self-directed investors a seat at our investment meetings. We publish these notes in a conversational format to get these out as quickly as possible for your consumption.

We recently had a one-on-one meeting with Henry J. Charrabe, Managing Director and CEO of Fluence Corporation Ltd (FLC). Fluence is an innovative wastewater treatment solutions provider, formed by the merger of Emefcy and RWL Water. The Company offers an integrated range of services across the complete water cycle, from early stage evaluation, through to design and delivery, to ongoing support and optimization of water-related assets. FLC remains on our watchlist as we track its pathway to sustainable profitability and margins.

Overview:

FLC is a global leader in mid-sized, decentralized water and wastewater solutions. The Company goes after projects that are in the capex range of US$5-50m and focus on areas where there are no large centralised treatment plants on which Mr. Charrabe noted (in the words to the effect of), “the idea is to build a smart package plant. The company delivered a fully operational desalination plant in Philippines within a week and that is our unique selling point. The world market in general is a US$700bn market but the decentralised space is the fastest growing space growing from US$13bn in 2016 to US$22bn by 2021 and we are the prime player in that field. Why the big guys are not playing because they are looking into US$600-800m projects and we are looking at US$20m and if I get the number 1 position in the US$20bn, it’s a pretty good position to be in”.

The reason why FLC is a leader in its space is because the barriers to entry in the market are very high. The small companies cannot afford to do a lot of engineering and package design and the big companies only focus on the big projects, so for middle range capex projects it’s hard to find a global player that competes with FLC not only in the offer they make but not also on the technology.

FLC has 22 partnerships in China with 10 plants already operating and 5 additional plants under construction. The Company has diversified its portfolio geographically with footprints in Latin America, China, United States and Western Europe. The Company plans to get a dual listing in the future preferably in the U.S. but regardless has no plans to de-list from the ASX.

At the moment, on a yearly basis the Company is on a 6%-7% recurring revenue but they are aspiring to be at about 30% recurring revenue on a yearly basis.

Competitive advantage:

The benefit for FLC is that they are a pure water waste global player meaning rather than other companies that also sell other products like turbines; FLU only focusses on waste water treatment plants on which Mr. Charrabe noted (in the words to the effect of), “we are a focussed company…we will not sell desalination in China, we will not sell domestic waste water with nitrogen removal in Argentina where nitrogen removal is not an issue…We know our market and we know our technology and the competitive landscape so we can address each market differently”.

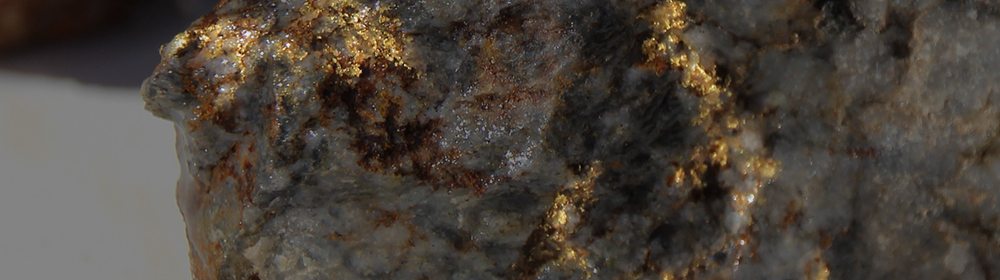

New IPO

Gold explorer currently undergoing an IPO. Seeking fast track to production. Register to receive the prospectus upon approval.

Technologies:

The three unique technologies that the Company focusses on are:

(1) MABR technology – For domestic waste water treatment. The technology is IP protected and FLC is the only company in the world to have that technology.

(2) NIROBOX – Desalination of packaged sea water using reverse osmosis system. FLC is the only company in the world that offers 1500 cubic metre/day sea water treatment capacity out of a 40ft container.

(3) Anaerobic Digestion – For treatment of industrial waste water, which using the technology is turned into methane gas which becomes electricity.

Competitive advantage in MABR technology.

Charrabe provided an overview of how the MABR technology works, noting in the words to the effect of, “the technology works like human lungs – like one side of your lungs has blood and other has oxygen and through your lungs it effortlessly goes from one side to other the same thing happens in waste water. In traditional methods you pump a lot of oxygen into waste water which is very inefficient, our technology changes the oxygen delivering method. It creates a sleeve which has a biofilm and on one side of biofilm you have waste water which is oxygen depleted and on the other side you have air which is oxygen saturated …so effortlessly it infuses with water but with use of 90% less energy as you don’t need to create a pressure for the two to infuse…this reduces opex by 50%”.

Revenue model.

As FLC is moving to smart package systems there is no more construction risk (because everything is plug and play and ‘lego’ model), which was a major risk in traditional EPC models. The Company primarily undertakes 3 different kinds of contracts;

(1) Pure turnkey – The customer pays on milestones 100% of the revenue by the time the plant is commissioned. This year 80% of FLC’s revenue is through this model (legacy business) in which after the construction, the Company hand’s over the project to the client.

(2) BOT Model (Built on Operating Transfer) – The Company is required to do financing for construction of the project and then provide operational maintenance after delivering the project. This model has a recurring revenue model on which Mr. Charrabe noted (in the words to the effect of), “we commenced the largest BOT project in Mexico, US$48m capex which is 70% debt financed through the North American Development Bank and after the 20 months of construction of the project we then have 30 years of recurring revenue of US$10m per year…another project is the project we announced in Bahamas where we are supplying 3 NIROBOX and after the delivery of those, which is happening this quarter we have years of operating maintenance”.

(3) Combination of both models where the company Constructs and maintains the project for the customer without investing its own equity.

Pathway to profitability beyond 2020 but we retain our conservatism and await earnings to be booked in FLC financial accounts.

Last year FLC had US$58m of revenue and with almost exact same SG&A, the management is forecasting a revenue of US$105m this year (hence this implies higher margin). The company is on a path to reach EBITDA profitability already but what concerns us is if the profits are sustainable because the projects are contract based so revenue might differ in quarters. Management has guided towards a profitable quarter in 2019 and a full year profitability from 2020 after which the company, according to Mr. Charrabe should be sustainably profitable.

New Contracts.

FLC recently signed an exclusivity agreement with a large Chinese state-owned entity, according to which over the next 3 years, the entity would purchase 66,000 cubic meter of waste water treatment from FLC which is equivalent to US$45m.

The company has moved to a standard dividend structure, with 70%-80% of reported net profit being paid to the shareholders.