14 August 2019

CSL continues to deliver pleasing results, coming in slightly ahead of guidance posted in May, with FY18 earnings (NPAT) up +29% on the previous corresponding period (pcp) (or up +28% on a constant currency, CC basis).

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 16/08/18 | CSL | A$214.17 | $222.50 | BUY |

| Date of Report 16/08/18 | ASX CSL |

| Price A$214.17 | Price Target $222.50 |

| Analyst Recommendation BUY | |

| Sector : Healthcare | 52-Week Range: A$119.01 – 205.03 |

| Industry: Biotechnology | Market Cap: A$91,244.7m |

Source: Bloomberg

INVESTMENT SUMMARY

We rate CSL as a Buy for the following reasons:

- Turnaround in the Seqirus flu business which recorded its first year of positive earnings (EBIT) in FY18.

- Solid FY19 outlook with strong demand expected to continue and supply of plasma expected to remain tight.

- Contribution from recently launched products (recombinant coagulation products – Idelvion & Afstyla).

- High barriers to entry in establishing expertise + global channels + operations/facilities/assets.

- Strong management team and operational capabilities.

- Leveraged to a falling dollar.

We see the following key risks to our investment thesis:

- Competitive pressures.

- Product recall / core Behring business disappoints.

- Growth disappoints (underperform company guidance).

- Turnaround in Seqirus flu business stalls or deteriorates.

- Adverse currency movements (AUD, EUR, USD).

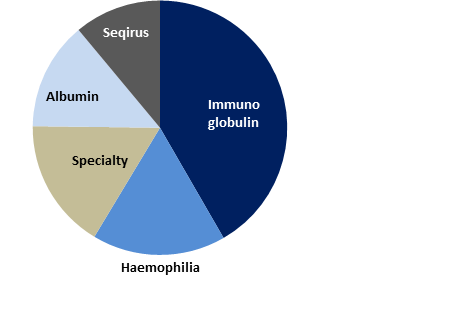

Figure 1: CSL Revenue by Product

Source: Company

Source: Company

ANALYST’S NOTE

CSL continues to deliver pleasing results, coming in slightly ahead of guidance posted in May, with FY18 earnings (NPAT) up +29% on the previous corresponding period (pcp) (or up +28% on a constant currency, CC basis).

The key highlight was CSL’s flu business (Seqirus) posting its first year of EBIT contribution, however, overall, all primary therapies across both segments posted sales growth.

Given the strong operating performance and management FY19 guidance, we have upgraded our estimates. We maintain our Buy recommendation and see further upside to current share price.

- Key highlights of FY18 results. 1. Revenue of $7,915m (up 11% on a constant currency (CC) basis). EBIT of $2,380m was up 33% in CC, while cash flow from operations of $1,902m was up +53%. Reported net profit after tax (NPAT) increased +29% from $1,337m to $1,729m (excluding a modest FX tailwind of $16m, CC growth was +28%). EPS of $3.82 was up +29% on a CC basis, which was slightly higher due to the residual impact of CSL’s share buy-back program. 2. Return on investment capital (ROIC) improved 140bps from 24.5% to 25.9%. 3. Final (unfranked) dividend declared of 93cps, bringing the total FY18 dividend to $1.72 per share, an increase of +26%. 4. CSL opened 27 new plasma collection centers in the US in FY18, bringing total collection centers worldwide to 206, leading the industry in addressing the supply constraints.

- On segments: Pleasingly, both segments contributed to the +33% growth in earnings (EBIT) at the group level. 1. For the CSL Behring business, though revenue was up a strong +10%, CSL Behring EBIT of $2,328m was significantly higher at +17%, attributable to margin expansion of 160bps to 34.1%. All therapy segments saw sales growth. IG saw +11% sales growth (CC) vs pcp, and positively, CSL received approval for Privigen in the US and Hizentra for the US and EU, both of which are treatments for CIDP. Haemophilia sales were up +5% (CC). Idelvion which is fast becoming a standard of care in Haemophilia B holds ~40% market share in key markets. Albumin sales grew +7% with strong demand continuing in China (Chinese sales up +11%, combined with continued expansion into Tier 2 and 3 cities). Specialty products grew sales +24% with the successful launch of Haegarda in the US, achieving ~50% US prophylactic market share. 2. Seqirus recorded its first year of positive EBIT contribution of $52m (from a -$179 in pcp), with margin of 4.8%, demonstrating that management’s strategy is on track. Revenue was at $1,088m (up 16% CC on pcp).

- Strong guidance for FY19. Management continue to anticipate “strong demand for CSL’s plasma and recombinant products”, as well as continued margin expansion as plasma mix shifts towards higher value products, and other divisions grow. Cost pressures, as well as supply constraints for plasma were pointed out, however management note their aim to open 30-35 new collection centers in FY19. Management stated guidance of NPAT for FY19 to be “~$1,880 to $1,950m” at CC, representing growth of 10-14%. Revenue growth is guided to be ~9%, Capex to be around ~$1.2-$1.3bn, while R&D will increase ~$150-$200m to ~10% of revenue post commencement of Phase 3 for CSL112. Indeed, on the analyst conference call, management pointed out “strong demand for our plasma recombinant products is expected to continue… margin growth that we’ve seen from our product mix shift, and in particular the transition of our coagulation portfolio will also be a feature that we expect to continue into FY19. We do expect the supply of plasma to remain tight and we’ll will continue to open new plasma collection centers ahead of the market”.

ASK THE ANALYST

Our analysts are ready to answer any questions you have

CSL FY18 RESULTS SUMMARY …

Figure 3: P&L summary

Source: BTIG, Company

Figure 4: CSL comps table – consensus estimates

Source: BTIG, Bloomberg

Figure 5: CSL Financial Summary

Source: BTIG, Company, Bloomberg

COMPANY DESCRIPTION

CSL Limited (CSL) develops, manufactures and markets human pharmaceutical and diagnostic products from human plasma. The company’s products include paediatric and adult vaccines, infection, pain medicine, skin disorder remedies, anti-venoms, anticoagulants and immunoglobulins. These products are non-discretionary life-saving products.

This Week’s News

7 August 2019