14 August 2019

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 09/08/18 | LEP | A$5.50 | A$5.20 | NEUTRAL |

| Date of Report 09/08/18 | ASX LEP |

| Price A$5.50 | Price Target A$5.20 |

| Analyst Recommendation NEUTRAL | |

| Sector : Financials | 52-Week Range: A$4.52 – 5.83 |

| Industry: REIT | Market Cap: A$1076.7m |

Source: Bloomberg

INVESTMENT SUMMARY

We rate LEP as a NEUTRAL for the following reasons:

- The Company is currently trading at a premium to its net tangible assets.

- Triple net leases to ALH (Australia’s largest pub operator which is 75% owned by Woolworths and 25% owned by Bruce Mathieson Group).

- High quality property portfolio with positive fundamentals and supportive demographics.

- Potential upside as LEP’s assets have significant land value (95 hectares) and LEP continues to explore development opportunities with ALH.

- Long term leases with average lease term of 10.3 years (and positive lease terms).

- 100% occupancy rate as all properties are leased to ALH.

- Sustainable distribution yield p.a. by at least CPI.

- Potential rental growth from upcoming rental reviews in 2018.

- FY19 distribution expected to be at least 50% tax deferred (previously 100% tax deferred due to progressive recovery of carried forward tax losses).

- Demand for pub property investment remains strong.

We see the following key risks to our investment thesis:

- Interest rate levels may rise or deterioration in credit/capital markets and thus reduced profitability and distributions

- Increases in QLD land tax rate from 2.0 to 2.5% may see FY19 earnings decrease by A$700k (0.38c per security).

- Any slowdown in demand and net absorption for retail space.

- Any deterioration in property fundamentals especially delays with developments, declining asset values, bankruptcies and rising vacancies.

- Declines in property valuations.

- Rental rates post reviews may be unfavorable.

- Weakness in rental demand – Slow wage growth and on the back of rising costs of living.

- LEP is exposed to single tenant risk from ALH and as such any default on rental payments. ALH is 75% owned by Woolworths (ASX: WOW), hence we believe this would be extremely unlikely, but negotiations for higher rents may be tougher.

- Adverse regulatory changes on liquor or gaming licenses could impact the profitability of tenants.

- Sentiment towards REITs as bond proxy stocks impacted by expected cash rate hikes.

Figure 1: : Properties by State

Source: BTIG, Company

Figure 2: : Property value by state

Source: BTIG, Company

ANALYST’S NOTE

ALE Property Group (LEP) reported solid but as expected FY18 results.

Key highlights to FY18 results included:

1. increased distributions by ~2.0% to $29.0m (or 20.8cps) – in line with manager expectations;

2. Weighted average adopted cap rate reduced from 5.14% to 4.98%;

3. Directors’ valuation of 86 properties increased by 5.0% to $1,136.3m;

4. Market rent review of 80 properties has commenced for FY19 and is expected to deliver a positive result;

5. Balance sheet remains solid with gearing at historic low of 41.6%, debt maturities diversified over the next 5.4 years and net debt 100% hedged for next 7.4 years with current all up cash interest rate of 4.26%;

6. FY18 property revenue of A$58.1m over the previous year, up +1.9% (driven by annual CPI based rent increases).

7. Weighted Average lease expiry was 10.3 years with the portfolio at 100% occupancy.

LEP is no doubt a quality business, with strong management team, strong property portfolio and solid balance sheet – We retain our Neutral recommendation on valuation grounds.

- Positive property revaluations. ALE’s 86 properties generated $58.1m in property revenue, up +1.9% on the previous corresponding period (pcp), largely driven by annual CPI rent increases across the portfolio. According to management, “statutory valuations of ALE’s properties increased by 5.0% to $1,136.3m … based on independent valuations of a representative sample of 35 of ALE’s properties conducted by CBRE, Savills, Opteon and Herron Todd White”. This mean that ALE’s weighted average capitalisation rate declined from 5.14% to 4.98% over the previous period.

- Upcoming rent reviews expected to be positive…whilst investors may be concerned around the upcoming market rent reviews in 2H18 for 80 of 86 assets, management highlighted that “ALE has enjoyed annual property rent increases at CPI over the past 14 years…with individual rent increases or decreases of up to 10%. Indeed, “ALE is confident of a positive result across the properties under review but we do not necessarily expect that all of the properties will achieve the maximum 10% rental uplift”. Following completion of the 2018 market rent reviews, management notes potential for enhanced distributions or capital management initiatives.

- Gains offset by increasing expenses. LEP saw revenue decrease by -0.3%, whereby CPI based rent increases across the portfolio were more than offset by increases in borrowing expenses. Borrowing expenses increased on additional borrowings and one-off items incurred in relation to refinancing done during the half. Management expenses were also higher due to additional costs from FY19 rent review preparations.

- LEP’s key and sole tenant, ALH continues to perform strongly. LEP is exposed to single tenant risk from ALH and as such, any default on rental payments (however unlikely in our view). ALH had 1. FY17 revenue of $4,256m, up +3.7% over the pcp; 2. EBITDAR of $803m, up +13.0% on pcp; and 3. EBITDAR margin of 18.9%. ALH is Australia’s largest pub operator with ~330 licensed venues, ~550 liquor outlets and ~1,900 short stay rooms.

- Sustainable debt profile + Gearing at an all-time low. LEP’s debt profile is spread out and staggered with maturity dates over the next 5.4 years, with base interest rates hedged conservatively for the next 7.4 years. LEP was able to maintain their all up-cash interest rate at 4.26% which is fixed until August 2020. LEP maintains investment grade credit rating of Baa2 (stable). LEP’s interest cover ratio is at 2.6x compared to covenant of 1.5x of the nearest Australian Medium-Term Note (AMTN). Gearing of 41.6% (versus 42.7% in FY17), means substantial headroom compared to the covenant gearing of 60% and significantly below the Company’s target range of 50-55%.

ASK THE ANALYST

Our analysts are ready to answer any questions you have

LEP FY18 RESULTS SUMMARY

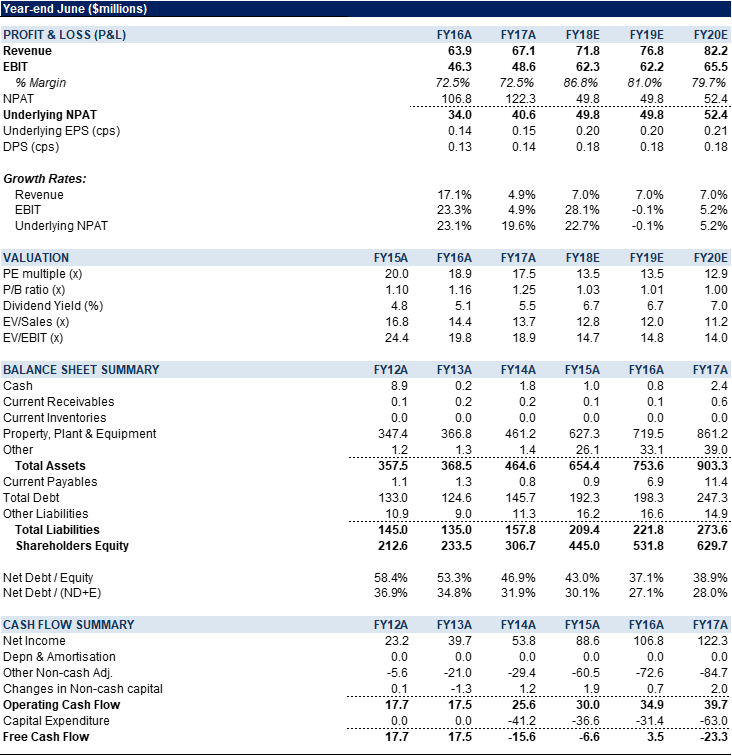

Figure 3: LEP Financial Summary

Source: Company

Figure 4: LEP Financial Summary

Source: Company,BTIG, Bloomberg

COMPANY DESCRIPTION

ALE Property Group (LEP) is the owner of Australia’s largest portfolio of freehold pub properties. Established in November 2003, ALE owns a portfolio of 86 pub properties across Australia, with a value of ~$1,080m (average value of $12.6m on weighted average cap rate of 5.14%). All the properties are leased to Australian Leisure and Hospitality Group Limited (ALH).

This Week’s News

7 August 2019