28 May 2019

Reach Markets publish the notes from our analyst meetings with company management. They should be read in conjunction with the research we’ve completed. Reach Markets endeavour to provide self-directed investors a seat at our investment meetings. We publish these notes in a conversational format to get these out as quickly as possible for your consumption.

We recently had a one-on-one meeting with Mark Dehring, Head of Investor Relations from CSL Ltd (CSL). The meeting was used as a refresher on the CSL story as well as to reassess our investment thoughts on the Company. Below are the key points from our discussion.

Porter’s five forces model

CSL’s core business is plasma therapeutics (plasma fractionation), in which the threats to new entrants are very low as it is difficult for new entrants to get hold of the plasma out of the U.S., so the industry has got enormous barriers to entry. There are even economic barriers to entry like high cost (to get into the business it requires to build a minimum $2bn fractionation plant, which would take 5-7 years to build, then another 5 years to run clinical trials, so it takes about 10 years before the product is out and then the issue of sourcing of raw materials like plasma becomes a question).

Moreover, the threat of substitutes for CSL’s core products like immunoglobulin (49% portfolio share) and Albumin (12% portfolio share) is negligible as these cannot be produced synthetically and CSL’s speciality products are not substitutable because of rarity of the disease they are used for (pharma companies don’t want to spend millions of dollars to develop a product (orphan drug) which is only required by a handful of people).

Further, the strength of CSL also lies in that their products are natural and are derived from the human body. This minimises the risk of harm relative to pharmaceuticals which may have drugs derived from plants and have toxic ingredients.

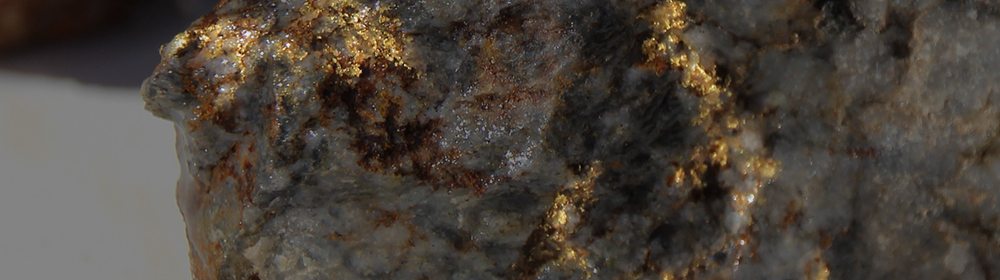

New IPO

Gold explorer currently undergoing an IPO. Seeking fast track to production. Register to receive the prospectus upon approval.

Products – widest portfolio compared to competitors and extra products on top of albumin and immunoglobulin improves margins

CSL is monetising 20 of the major proteins found in human blood, the significant ones being immunoglobulin and albumin on which Mr. Dehring noted in the words to the effect of, “last year we put about 14 million litres of plasma through our manufacturing spine and we took out immunoglobulin and albumin. You can buy the plasma in market for $160/litre which costs about $80 to convert and $20 for working capital cost. It takes about 9 months to take it out from someone’s vein, process it and put it back into someone else’s vein and the working capital cost is actually quite high…so we have $260 of cost at gross margin line per litre of plasma. Grifols is paying this amount of money but our cost is much cheaper. We get 25gm of Albumin (selling at $3 per gram) and 4gm of immunoglobulin (selling for $60 per gram) out of each litre of plasma, so 1 litre of plasma earns us $315.”

On top of the two core products, CSL has a big portfolio of speciality products like alpha1, Kcentra etc which Mr. Dehring described as ‘icing on the cake’, which helps CSL earn extra revenue on top of what it earns selling its 2 core products.

Growth catalysts to focus on

The company considers 4 of its products as growth catalysts going forward;

1. Idelvion (used for treatment of Hemophilia B) is one of its best product on the grounds that it is only needs to be administered once every two weeks as compared to its substitutes, which have to be taken 3 times a week (i.e. it is less painful for patients as they are required to inject less times). Idelvion has a market size of $1.3bn, of which CSL owns 1/3 and expect to grow it to 50%.

2. Haegarda, which is used for prevention of Hereditary Angioedema, has significantly reduced the bleeding (patients were bleeding 50% of the time to now only bleeding 5% of the time).

3. Kcentra for which CSL has sole right to command (orphan drug status) by FDA, which means CSL own 100% of the market share.

4. Hizentra, which is used for treatment of patients with Chronic Inflammatory Demyelinating Polyneuropathy (CIDP).

CSL112 – a gamechanger

In his concluding comments Mr. Dehring talked about CSL112, which he called a ‘gamechanger’ noting in the words to the effect of, “we have moved in phase 3 and we have our first futility in 2020, which means a third party will looks at the data and they would say CSL stop wasting your money this is going south. If they say nothing than that’s great and we’ll continue…what we don’t want is messy data…the first efficacy data which is like a half way point is in 2021 and then in 2022 we are looking at complete data and then hopefully in 2023 we get FDA approval and launch it into the market.”

Patents protection of products minimal; manufacturing process is key to higher margins

Dehring noted in the words to the effect of, “patents matter in the industry, however with these products it’s hard to get patents. We can try and patent manufacturing processes but the reality is that patents are only good for us for a certain number of years anyway and then you hit the cliff. So the good news is that if there are no patents there is no cliff, bad news is we don’t have that protection…we do have lots of patents and depends on which part of the business for example in flu business we have got patents, for some of our antibodies we have patents but for bulk of our business we don’t have patents.”

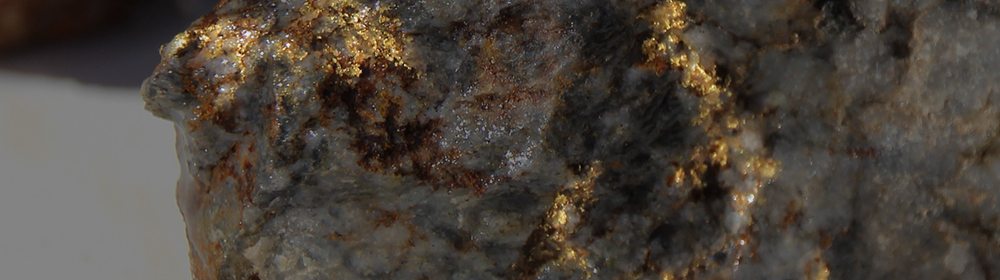

New IPO

Gold explorer currently undergoing an IPO. Seeking fast track to production. Register to receive the prospectus upon approval.

Operating efficiency is a function of efficient manufacturing process + efficient standardised collection centres

CSL has the best margins in the business and its collections business is run very efficiently. CSL is targeting 30-35 collection centre openings in 2019 (27 in 2018). Each centre approximately provides 100k litres of plasma. The FDA requires the centre to be fully staffed upon launch and it takes 2-3 years to ramp up.

The company has 206 collection centres in the U.S. (8 in Germany, 4 in China, 3 in Hungary) and whenever they set a centre up its standardised (same as the existing centres), so they can easily move staff around centres without them undergoing any additional training. Moreover, CSL’s plasma collection process is around 90 minutes compared to competitors, which have a collection process of 2 hours.

CSL also has recipients of their products (patients) and doctors visit their collection centres to talk with donors about how important their blood is. Collection in the U.S. remains the key as most other countries are willing to allow their citizens to receive CSL products as FDA provides oversight in the U.S.

The donor base is 25% unemployed and 75% employed. As the U.S. economy is booming CSL faces inflationary cost pressures as the donors and the staff have started to demand more money. U.S. wages are going up. The question for donors who receive ~US$45 per visit (and who can donate 2-3 times per week) is whether the payment is greater than their hourly wage.

In our view CSL still remains at an advantage due to its high efficiency as the inflationary pressures would be hitting its competitors much harder due to low efficiency.