14 August 2019

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 22/08/18 | PRY | A$2.75 | A$2.43 | SELL |

| Date of Report 22/08/18 | ASX PRY |

| Price A$2.75 | Price Target A$2.43 |

| Analyst Recommendation SELL | |

| Sector: Healthcare | 52-Week Range: A$2.90 – 3.97 |

| Industry: Healthcare Services | Market Cap: A$1,926.1m |

Source: Bloomberg

INVESTMENT SUMMARY

We rate PRY as a Sell due to the following reasons:

- The pace of recruitment and retention of healthcare professionals to be slower than expected. Significant changes to contracts with healthcare professionals that are unfavorable to PRY (and less beneficial to PRY’s bottom-line than in prior years).

- Management team in transition with new CEO due to commence.

- Competitive risk and market share loss to other listed and unlisted medical facility operators.

We see the following key risks to our investment thesis:

- Recruitment of healthcare professionals occurs at a faster than expected pace and on favorable contractual terms to PRY.

- Regulatory risk associated with changes to Government policy are clarified and to the benefit of PRY.

- PRY remains one of the major vertically integrated medical facility operators in Australia, with potential to improve operational leverage as GPs (and other health professionals) are recruited to the business.

- Near term risks are short lived and longer term, PRY benefits from attractive industry fundamentals (for instance, increasing aging population or population with chronic disease requiring medical care) with inflation proof and defensive earnings.

- Substantial shareholder, Jangho Group remains on the register which may lead to potential corporate activity (especially takeover at a premium).

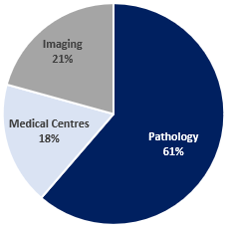

Figure 1: PRY Revenue Split by Segment

Source: Company

Figure 2: PRY EBITDA Split by Segment

Source: Company

ANALYST’S NOTE

Since our sell recommendation, the share price has declined -25%. In our view, although underlying NPAT was broadly in line with last year and with guidance, Primary Healthcare (PRY) delivered results which were disappointing given revenue was up ~4.9%, EBITDA down -9.3%, EBIT down -4.4%.

Free cash flow, before growth capital expenditure, was $146.6m, an improvement on FY17. Final dividend of 5.5 cps, 100% franked, on a payout ratio of 60% of Underlying NPAT. Further, PRY announced a $250m capital raising. Offer issue price is $2.50 per new share, a 17.8% discount to theoretical ex-rights price of $3.04 on 17 August 2018. Retail entitlement offer opens on 27 August 2018 and closes on 7 September 2018. PRY trading halt is lifted on 22 August 2018.

For investors currently in the stock, if the share price before the close on 7 September 2018, appreciates significantly beyond $2.50, we recommend take up and sell (to receive the benefit of the arbitrage). Overall, we maintain our Sell recommendation.

- $250m capital raising and potential acquisition… PRY announced an underwritten $250m pro rata non-renounceable entitlement offer for 5.21 new shares at $2.50 per share (ex final FY 2018 dividend of 5.5cps). On completion PRY will have a pro-forma net debt/FY 2018 underlying EBITDA of 1.9x. PRY’s largest shareholder, Jangho Group, has provided an irrevocable commitment to subscribe for 100% of its pro rata share of offer. The funds will be used to 1. Over the next 3 years, invest ~$140m “to increase operational capacity in existing Medical Centres, deliver additional services and improve its ability to recruit and retain health care professionals in its Medical Centres division”; 2. Over the next 5 years, invest ~$100m to deliver a superior and differentiated Pathology infrastructure platform designed to increase operational efficiency, deliver significant clinical outcomes and support the continued growth of its Pathology Division. 3. PRY is in negotiations to acquire a leading day hospital operator with pro forma FY 2018 EBITDA of $7m for a total of ~$140m over a three-year period, including an upfront payment of $75m (if the acquisition proceeds) and future contingent payments related to operational milestones and performance. PRY is targeting greater than 15% return on investment from these projects.

- FY19 guidance with 1H19 expected to be weak. PRY’s management “expects underlying NPAT in FY19 to be at or above FY18 underlying NPAT, prior to the impact of the capital raising and potential acquisition…[further] based on current trading activity, industry growth is expected to be slower in 1H 2019 and then normalise to long‐term growth rates”.

- Pathology (~49% of EBITDA). The segment grew revenue by +5.0% despite the loss of the national bowel screening contract from January 2018 driven by growth in specialties such as histopathology, genetics and vets pathology. EBIT was up +4% when adjusted for the planned sale of the Healthscope collection centers. The segment was also able to reduce its property costs as a percentage of revenue, due to collections center rental negotiations.

- Medical centres (~32%% of EBITDA). Earnings (EBITDA) was down -22.9% as margins contracted from 38.6% in FY17 to 29.8%. On the analyst call, management pointed out the disappointing results but noted “we [are] near the bottom of profit contractions due to repositioning our GP contracts. There are only about a quarter of that cohort still on the old five-year contract. In terms of our GP numbers, we recruited a record 159 new GP this year, and have laid the foundations for strong successful recruitment in the future”.

- Imaging (~19% of EBITDA). Imaging division continued to see solid growth with EBIT up +16.6% on the back of an +10.5% increase in revenue driven by PRY’s “focus on the hospital and medical centers channels and on MRI and CT”.

PRY Results Summary

Figure 3: PRY Financial Summary

Source: Company

Figure 4: Peer group comparables – consensus

Source: Bloomberg

Figure 5: PRY Financial Summary

Source: BTIG, Company, Bloomberg

COMPANY DESCRIPTION

Primary Heath Care Ltd (PRY) operates 1) ~90 primary health care clinics in Australia. Its medical clinics are vertically integrated with family GPs, specialists, therapists; 2) ~90 pathology laboratories (along with ~800 specimen collection centres); and 3) over 160 diagnostic imaging centers. PRY offers different billing options through Medicare (Australia’s universal healthcare system) and bulk billing.

This Week’s News

7 August 2019