14 August 2019

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 28/08/18 | TGR | A$4.50 | A$4.90 | BUY |

| Date of Report 28/08/18 | ASX TGR |

| Price A$4.50 | Price Target A$4.90 |

| Analyst Recommendation BUY | |

| Sector : Consumer Staples | 52-Week Range: A$3.44 – 4.68 |

| Industry: Packaged Foods & Meat | Market Cap: A$786.8m |

Source: Bloomberg

INVESTMENT SUMMARY

We rate TGR a Buy for the following reasons:

- Capital raising should accelerate TGR’s growth plans without the need to leverage the balance sheet further.

- Number one player in the domestic market (approximately 50% market share), with only one major competitor (Huon Aquaculture Group). This could see rational pricing behaviour, which should be positive for both companies.

- High barriers to entry (assets, desired temperatures and regulatory licences are difficult to obtain).

- Initiatives like selective breeding programs and investments in infrastructure appear to be paying dividends, with more recent generations of TGR’s salmon showing more robust growth than their predecessors.

- Given the complex nature of salmon farming, TGR is unlikely to have its dominant position as an Australian leading salmon farmer seriously threatened in the foreseeable future.

We see the following key risks to our investment thesis:

- Impact on production due to adverse weather conditions and diseases.

- The De Costi acquisition presents an opportunity for diversification, however execution and competitive risks remain.

- Potential review of chemical colouring in salmon may lead to further negative publicity and undermine demand for salmon.

- Cost pressures or cost blowout could deteriorate margins significantly given the large cost base relative to earnings (EBITDA).

- Irrational competitive behaviour (domestic and international markets).

Figure 1: TGR revenue by markets

Source: Company

Figure 2: TGR revenue by segment

Source: Company

ANALYST’S NOTE

TGR’s FY18 operating profit of $50.3m and operating EBITDA of $99.78m came in below consensus estimates of $51.2m and $105.5m respectively.

The share price showed marginal improvement as investors focused on underlying growth in operating profit and EBITDA of +19.2% and +12.2%, respectively, and management stating, “there appears to be a supply shortage for domestic market fulfilment, and this should lead to strong pricing returns and an improved domestic pricing outlook”.

TGR announced the acquisition of Fortune Group’s prawn aquaculture business and the lease of a Well Boat.

Looking forward, we expect average prices to recover in FY19 on lower volumes in export and domestic market.

We maintain our Buy recommendation, given the upside to our current price target. On our estimates, TGR is trading on a FY20E PE-multiple of 12.1x and offering a fully franked yield of ~3.9%..

- Favorable salmon market dynamics. TGR’s strategy of managing sales mix and optimising margins continued to allow it to take advantage of favourable salmon pricing and increase its contribution margin. Optimisation of domestic salmon sales mix saw wholesale sales volume up +6.1% with sales revenue up +6.2% and retail sales volume up +11.2% pushing sales revenue up by +4.5%. However, the average price for salmon has declined in both domestic and export markets by -3.5% and -10.6% respectively but management feels that the global pricing should increase by more than 20% (from FY17 pricing) in FY19 as salmon demand is outpacing supply both domestically and globally.

- Acquisition – prawn aquaculture. Management announced that De Costi Seafoods Pty Ltd, has signed sale agreements to acquire the land, assets and inventory of Fortune Group prawn aquaculture business, comprising of three prawn farms located at Yamba (NSW), Proserpine (Queensland) and Mission Beach (Queensland). If integrated well, in our view, this acquisition would drive revenue growth, as there is high demand of prawns but there has not been material growth in Australian grown prawn supply from last 10 years.

- FY19 Outlook positive. No specific guidance numbers were given but management expects an increase in harvest production and sales in FY19, with global pricing up +20% from FY17 driven by strong demand from China and North and South America outstripping the supply. Management feels that TGR is well positioned from balance sheet perspective to drive growth and noted that the company has additional biomass available for sale in FY19. The CEO noted, “Tassal’s strong salmon position will see the Company deliver increased harvest production and sales in FY19. Continued domestic demand growth outstripping supply will underpin increased pricing in the domestic market, while we will continue to use the export market, particularly Asia, to optimise fish size and underpin production efficiencies. The combination of all of this, will see Tassal deliver another record result in FY19.”

- Well Boat to provide biomass improvement and reduce overhead costs. Management announced that TGR would be taking possession of a Well Boat under a 10-year lease (with TGR holding a 5-year option), which would help provide complete bathe of the pens ~3x quicker than current methods, significantly reducing labour and overhead costs and providing additional biomass benefits through improvements in survival.

FY18 Results Summary…

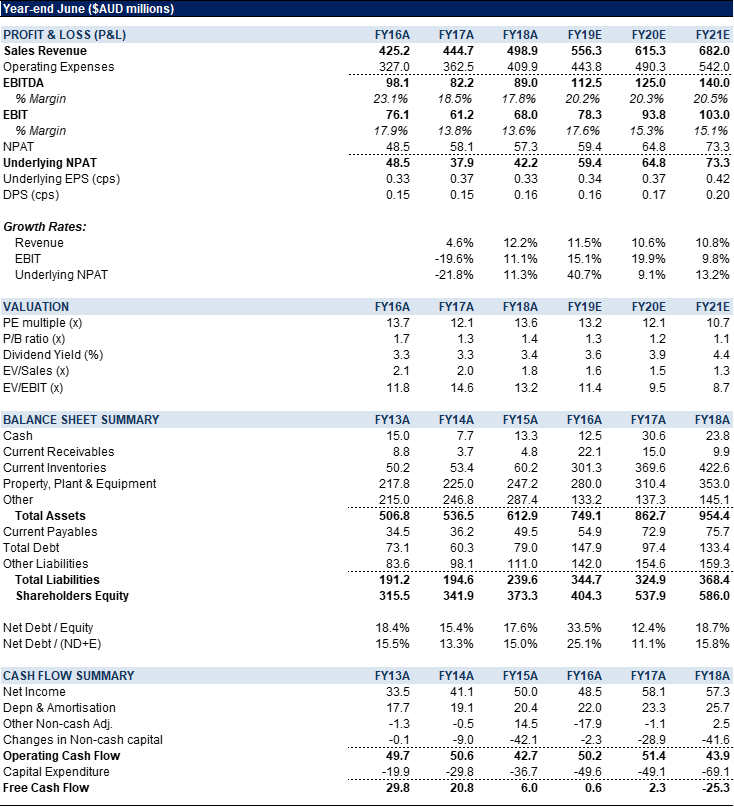

Figure 3: TGR FY18 key performance numbers

Source: Company

FY18 results highlights. When compared to pcp: 1. Revenue was up +13.1%, operating earnings (EBITDA) up +12.2% and operating NPAT up +19.2%. 2. Group results were driven by strong demand for salmon, especially in wholesale markets with export volumes up +98.4%, partially offset by cost pressures. 3. Average fish size improved +15.4% to 4.5kg, from 3.9kg in pcp. 4. EBITDA was driven by strong consumer demand for salmon, which helped improve pricing conditions and allowed for further optimization of sales mix to maximize margins. 5. Gearing increased to 18.7% from 12.4% in FY17. 6. Operating cash flow of $43.9m was down -14.6% from $51.4m in FY17. 7. Fully franked final dividend of 8cps (up +6.7%) was declared, bringing the total dividend payout for FY18 to 16cps (up +6.7% from pcp

Relative valuation…

Figure 4: TGR domestic and global peer group trading multiples – consensus

Source: Bloomberg

Figure 5: TGR Financial Summary

Source: Company, BTIG, Bloomberg

COMPANY DESCRIPTION

Tassal Group (TGR) is Australia’s largest vertically integrated seafood/aquaculture company. Based in Tasmania, TGR is engaged in hatching, farming, processing, sale and marketing of Atlantic salmon and ocean trout. The company’s products are distributed in Australia, Japan and other international markets.

This Week’s News

7 August 2019