14 August 2019

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 03/09/18 | NXT | A$6.98 | A$7.80 | BUY |

| Date of Report 03/09/18 | ASX NXT |

| Price A$6.98 | Price Target A$7.80 |

| Analyst Recommendation BUY | |

| Sector : Information Technology | 52-Week Range: A$4.22 – 8.19 |

| Industry: Software & Services | Market Cap: A$2,422.4m |

Source: Bloomberg

INVESTMENT SUMMARY

We rate NXT as a Buy for the following reasons:

- Australia is still in the early stages of cloud adoption. More efficient and cheaper broadband following the NBN’s implementation will drive demand from cloud providers for NXT’s assets.

- Extremely high quality collection of sites.

- NXT has the balance sheet capacity to handle more debt and self-fund expansion through operating cash flow from the base buildings.

- Capital intensive nature of sector provides high barrier to entry.

- Government adoption of cloud and the subsequent need to outsource presents an opportunity.

- Strong customer ecosystem creates a ‘sticky’ customer base who are unlikely to churn.

- National footprint allows Company to scale better than competitors.

- Margin expansions highlighting strong operating leverage.

- Additional capacity announced.

We see the following key risks to our investment thesis:

- No product diversification (NXT only operates data centres).

- Data centre fires or accidents.

- Competitive pressures (price discounting by NXT or competitors).

- Higher power densities as a result of increasing average rack power utilization in Australia.

- Insufficient customer demand to achieve a satisfactory return on investments.

- Failure to obtain sufficient capital on favorable terms may hinder NXT’s ability to expand and pursue growth opportunities.

- Lease risk (NXT does not own the land or building where its data centres are situated).

Figure 1: NXT revenue by industry

Source: Company

Figure 2: Revenue by facility

Source: Company

ANALYST’S NOTE

NEXTDC Ltd (NXT) reported solid FY18 results, which saw revenue up +30% to $161.5m and the strong operating leverage saw underlying EBITDA increase by +28% to $62.6, both figures surpassing guidance ranges of $152 – 158m and $58 – 62m respectively.

We maintain our recommendation based upon:

1. NXT’s EBITDA growth – underscoring the Company’s effective operating leverage;

2. potential for further capacity expansion (new and existing facilities);

3. strong corporate cost performance and upcoming near term benefits of scale;

4. quality assets and locations;

5. positive outlook for industry growth; and

6. solid balance sheet

For FY19, management has announced the development of three new sites – P2, S3, M3 (following the opening B2 and S2 centres in FY18), and guides revenue between a range of $183 – 188m, Underlying EBITDA between $83 – 87m and CAPEX between $430 – 470m.

We have updated our earnings estimates and peer group trading multiples. For FY19E, we are largely in line with management’s guidance. Our equal-weighted and blended (DCF, PE-multiple, EV/EBITDA) valuation arrives at $7.80 per share.

- FY18 Key results – highlights: Over the pcp, NXT saw

1. Total revenue up +30.7% to $161.5m (beating guidance range of $152 – 158m), with contracted utilisation up +28% to 40.2MW and Interconnections (6.5% of recurring revenue) up +37% to 8,671.

2. Underlying EBITDA followed strong top line growth, up +27.8% to $62.6m (beating guidance range of $58 – 62m).

3. EBITDAR margin down slightly at 53% (from 56% in FY17).

4. NPAT down -71% to $6.6m.

5. Operating cash flow declines of -25.6% to $33.4m.

6. Capex of $285m, versus guidance range of $307 – 327m.

7. Balance sheet capacity with cash and term deposits of $418m, and $300m of senior secured debt facility remaining undrawn.

8. Investment of $285m over the year, and

9. the opening B2 (Brisbane) and M2 (Melbourne sites) during the year. - Strong global and domestic demand for data storage services. The increasing use of Big Data, IoT and analytics software has led to global mobile data traffic being tipped to increase at +53% CAGR through to 2020. Since the cost of building and maintaining a data center is very costly and time consuming, demand for DCaaS (Data Centre-as-a-Service) is predicted by Frost & Sullivan to grow by 12.4% per annum to 2022 in the same trajectory to house the new data traffic. The data stored globally in data centers is expected to quintuple by 2020 to reach 915 EB (exabytes) with a 40% CAGR, as a result of increasing big data volume (58% CAGR between 2015-2020) and personal cloud storage users (12% CAGR 2015-2020). Supply is also expected to grow 5-fold to 1.8 ZB in 2020.

- Pricing trends stable. Annualised revenue per MW was up +9% on pcp, with management noting that they are not seeing much activity on the pricing side, with competitors mostly rational – “we continue to see a lot of discipline in the industry”. Annualised revenue per square metre was up +11.7%, with management noting that upcoming facility developments will take advantage of such industry movements toward higher density requirements.

FY18 Results Summary…

Key operating metrics for the FY18 are presented in the table below versus the previous corresponding period.

Figure 3: NXT FY18 results summary

Source: BTIG, Company

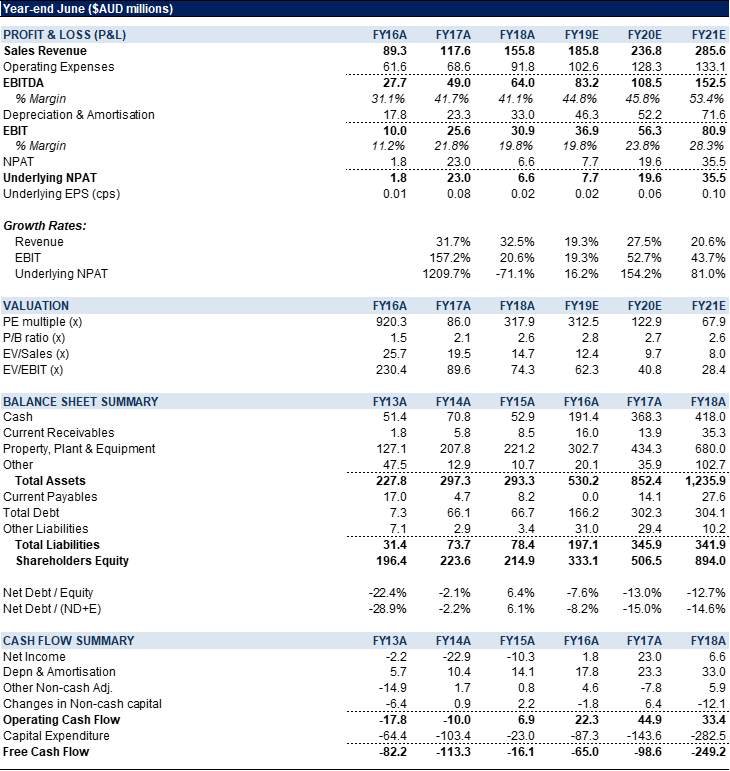

Figure 4: NXT Financial Summary

Source: BTIG, Company, Bloomberg

COMPANY DESCRIPTION

NXT Limited (NXT) is a Data-Center-as-a-Service (DCaaS) provider offering a range of services to corporate, government and IT services companies. NXT has a total of five data centers located in major commerce hubs in Australia, with three more due to be completed within the next 2 years. These facilities are network-neutral, meaning they operate independently of telecommunication and IT service providers. Currently NXT has a total of 34.7 MW built for data and serving housing, with a target to reach 104.1MW by the end of 1H18.

This Week’s News

7 August 2019