14 August 2019

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 27/08/18 | MPL | A$3.03 | $3.44 | BUY |

| Date of Report 27/08/18 | ASX MPL |

| Price A$3.03 | Price Target $3.44 |

| Analyst Recommendation BUY | |

| Sector : Financials | 52-Week Range: A$2.79 – 3.39 |

| Industry: Life & Health Insurance | Market Cap: A$8,344.6m |

Source: Bloomberg

INVESTMENT SUMMARY

We rate MPL as a Buy for the following reasons:

- Given Australia’s growing and ageing population, there will be increased demand for health care services. This will add additional pressure on Australia’s public health care system and the Federal budget and an increased dependence on private health care insurers. NHF offers exposure to the business model of providing a funding mechanism for the high-growth health care sector. Healthcare spending is expected to grow at 5-10% per annum, so without significant tax hikes, the government cannot afford for people to shift back to the public healthcare system.

- Given underlying increases in average premium rates of around 5 – 6% p.a., some policyholder growth (especially at the 30-34-year-old segment), we estimate that MPL offers close to low double-digit underlying growth in the medium term.

- MPL has delivered an impressive 10-year average combined operating ratio of 95% and ~13% ROE.

- Potential to improve the company’s expense ratio.

- Room for industry-wide benefits such as losses from risk equalization fund as non-profitable players are consolidated.

- Incentives and benefits encourage PHI take-up. They include 1. Tax benefits and penalties for Australian residents (via Lifetime Health Cover, Medicare Levy Surcharge and means tested rebate); and 2. Shorter wait times, a choice of specialist doctor/hospital and coverage of ancillary health services support.

We see the following key risks to our investment thesis:

- Intensifying competition between top 6 players, putting policy growth targets at risk and any increases in expected marketing spend going forward will no doubt add further strain on earnings growth.

- Policyholders declines unexpectedly, despite the incentives and Australian Government struggling with the rapid increase in healthcare spending and health services demand.

- Registered health insurers cannot increase premium rates without approval from the Government/Minister for Health/PHIAC/APRA. This leaves NHF’s ROE and margins exposed to a political process and pressures if the company is deemed too profitable.

- Regulatory changes especially relating to any changes to tax incentives and benefits which encourage take up of PHI.

- Higher than expected lapse rates and claims inflation as a result of poor insurance policy design, aging population, and costs of new medical equipment, procedures and treatments;

- Poor negotiations with healthcare providers such as private hospital operators leading to unfavourable contractual terms;

- Lower than expected investment returns.

Figure 1: Population growth and Participation rate

Source: Company

ANALYST’S NOTE

Medibank Private (MPL) reported FY18 results with NPAT of 445.1m and EPS of 16.2cps, both of which came in below market estimates of $453.8m and 16.7cps respectively, dragging the share price down by -2.2% at the close.

Given the industry is facing issues of customer affordability, we think the health insurance business performed well delivering revenue of $6.3bn up +1.2% over pcp. Group NPAT of $445.1m, down -1% from $449.5m in FY17 with solid results from Medibank Health offset by lower net investment income (lower equity and credit market returns) however, group EBITDA rose +9.7% to $548.8m.

Management noted that market share grew by 5bps over the past 6 months. MPL delivered a dividend at 80% of NPAT. Operating profit increased +32.5% and gross margin improved 110bps.

We remain concerned over short term issues such as affordability of private health insurance (and hence policyholder growth numbers) that all private health insurers are dealing with.

MPL is currently trading on reasonable ~18.3x forward P/E, 4.3% yield, attractive ROE of ~25% – we are cognizant of short-term challenges, but longer term, we don’t doubt the quality of MPL. Reiterate Buy.

- Health Insurance. Health Insurance premium revenue was up +1.2% to $6,319.5m with policyholders growing by 4,800 in FY18, compared to a 24,200 reduction in FY17. Operating profit increased by $38.1m to $535.6m, which reflects the benefits from productivity program and a higher claims provision release, partially offset by the one-off $20m investment in the launch of customer loyalty program. Health claims (excluding risk equalisation) paid on behalf of customers rose by +0.1% to $5.3bn, however Health Insurance gross margin increased by 20bps to 17.3% in FY18. Management expenses were down by -2.0% to $557.2m, with management expense ratio (MER) down to 8.8% from 9.1% in FY17 reflecting progress made on productivity program (delivering savings of ~$20m).

- Medibank Health. Medibank Health revenue rose +6.9% to $615.9m, primarily driven by contribution from newly acquired HealthStrong and growth in Diversified business which includes sale of travel, life and pet insurance products. Operating profit increased +32.5%, with a 110bps improvement in gross margin reflecting diversification of Medibank Health.

- Investment income. Net investment income fell by -31.4% to $95.6m, as both growth and defensive portfolios delivered low returns and management adopted a more conservative approach to asset allocation.

- Capital ratio at the upper end of target. Health Insurance related capital was $895.3m, equating to ~14% of premium revenue which is at the top end of the Board’s stated target range of 12% to 14%.

- FY19 outlook – no specific guidance. Management did not provide any quantitative guidance but expect flat PHI market volumes to persist with the company targeting modest market growth in FY19. Hospital utilization growth is expected to remain subdued with ancillary utilization growth expected to be marginally lower and management expenses are targeted to be modestly above FY18 numbers. Management noted that they are targeting the dividend payout ratio to be at the top end of 70%-80% range and expect to make an acquisition in FY19 which is expected to cost $70m.

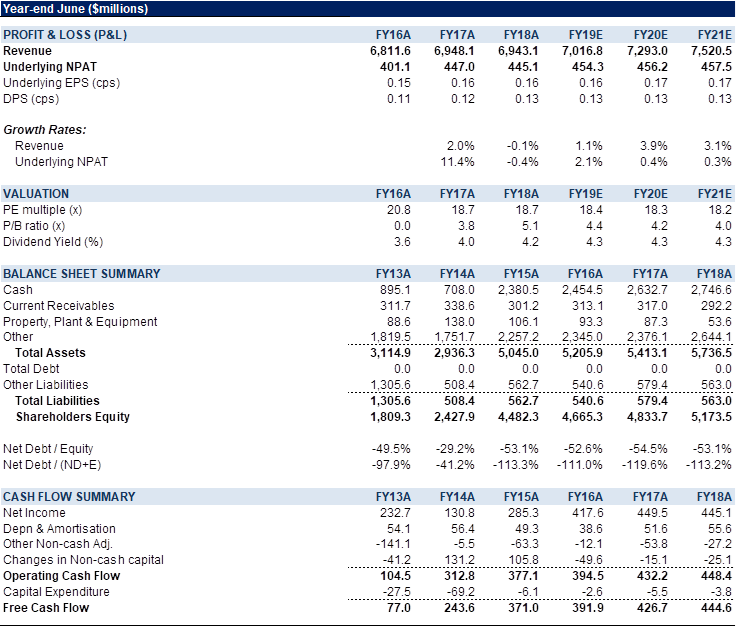

MPL FY18 RESULTS SUMMARY

Figure 2: MPL FY18 Results Summary

Source: Company

Figure 3: MPL Financial Summary

Source: Company

COMPANY DESCRIPTION

Medibank (MPL) is Australia’s largest private health insurer with ~30% market share. Medibank’s health insurance business (Health Insurance) underwrites private health insurance and the insurer generates revenue from a number of complementary services.

This Week’s News

7 August 2019