14 August 2019

Bapcor Ltd (BAP) FY18 results were largely in-line with consensus estimates, with proforma NPAT of $86.5m coming in consensus range of $85.2m-90.3m which saw the stock price increase marginally.

COMPANY DATA

| Date of Report | ASX | Price | Price Target | Analyst Recommendation |

| 24/08/18 | BAP | A$6.95 | A$6.74 | NEUTRAL |

| Date of Report 24/08/18 | ASX BAP |

| Price A$6.95 | Price Target A$6.74 |

| Analyst Recommendation NEUTRAL | |

| Sector : Consumer Discretionary | 52-Week Range: A$5.19 – 7.24 |

| Industry: Distributors | Market Cap: A$1,939.3m |

Source: Bloomberg

INVESTMENT SUMMARY

We rate BAP as a Neutral for the following reasons:

- The stock price is trading largely in line with our valuation and price target.

- Strong earnings growth profile.

- Further opportunity to grow gross profit margins from better buying terms with tier one and two suppliers.

- Significant distribution network across Australia to leverage from.

- Ongoing bolt on acquisitions and associated synergies.

- Growing BAP’s own brand strategy, which should be a positive for margins.

We see the following key risks to our investment thesis:

- Rising competitive pressures.

- Value destructive acquisition.

- Rising cost pressures eroding margins (e.g. more brand or marketing investment required due to competitive pressures).

- Given the high trading multiples the stock trades at, a disappointing earnings update could see the stock price significantly re-rate lower.

- Integration (and therefore synergies) of recent acquisitions underperform market expectations.

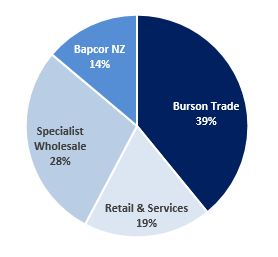

Figure 1: Revenue by segment

Source: Company

Source: Company

ANALYST’S NOTE

Bapcor Ltd (BAP) FY18 results were largely in-line with consensus estimates, with proforma NPAT of $86.5m coming in consensus range of $85.2m-90.3m which saw the stock price increase marginally.

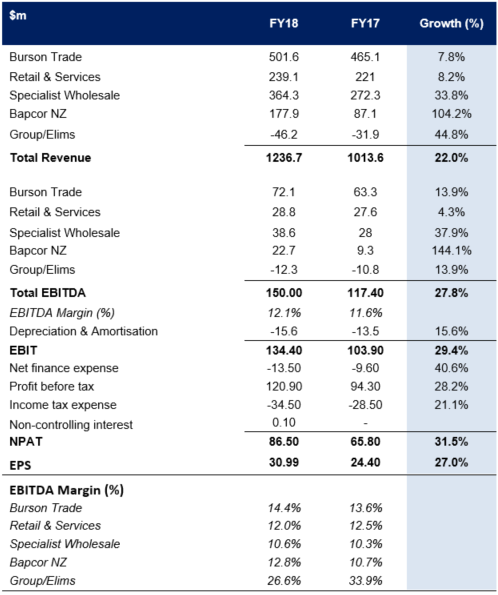

Key financial highlights (including the Hellaby business) versus the previous corresponding period (pcp): 1. revenue up +22% to $1.23bn; 2. Underlying EBITDA growth of +28% to $150m; 3. Proforma NPAT up +31.6% to $86.5m; and 4. EPS at 30.99cps (a +27% increase), indicating healthy organic growth in the underlying business.

Management declared a final fully franked dividend of 8.5 cents per share (up 13.3% compared to the pcp), bringing the total dividends for FY18 to 15.5 cps (up 19.2%). Further, management noted that consensus estimate of FY19 EBITDA of $170m was reasonable and they expect an increase in NPAT of 9%-14% above FY18 proforma NPAT.

We maintain our Neutral recommendation only on valuation grounds only but note management guidance of a strong year ahead (our numbers are on the lower end of guidance or on the conservative side).

- Other FY18 Highlights. 1. Net debt was $289.5m, representing a leverage ratio of 2.0X, was in line with Bapcor’s FY18 target. 2. Strong cash conversion of 98.9% with $57.1m net cash generated excluding acquisitions, dividends and divestment proceeds. 3. Completed divestment of non-core assets of Contract Resources, TBS and Footwear with investment proceeds of NZ$103m.

- Burson Trade – strong results. Trade revenue increased by +7.8% to $501.6m led by strong equipment sales growth and EBITDA grew by +13.9% to $72.1m compared to FY17, achieving same store sales growth of +4.4%. Margins also increased by +80bps to 14.4%. BAP acquired Tricor Engineering, a specialist in supply and installation of lubrication equipment for workshops and opened 10 new stores taking the total store count to 170.

- Retail & Service – making good progress. Revenue for FY18 increased by +8.2% compared to pcp, which included a higher mix of company owned stores versus franchise operations across its store network. EBITDA increased +4.4%, while EBITDA margins declined by 50bps, due to increased sales from the new company owned stores, impacting revenue mix. Same store sales growth for company owned Autobarn stores was up +4.7% franchise stores was up +1.4%. Autobarn added 17 new company owned stores to its network during the year, consisting of 8 greenfield stores and the conversion of 9 franchise operations, bringing the total number of company owned Autobarn stores to 48.

- Specialist Wholesale. The Specialist Wholesale segment which comprises eleven business units grew revenue by +33.8% and EBITDA by +37.9% to $364.3m and $38.6m respectively. Revenue increased +11.0% and EBITDA grew by +16.2% (if we were to consider inclusion of Hellaby in full year results). Good performance was recorded across all Specialist Wholesale businesses and BAP acquired AADi (importer/distributor of driveshafts, CV’s, wheel bearings and shock absorbers).

- Bapcor New Zealand. Revenue was $177.9, and EBITDA was $22.7 in FY18 an increase of +104.1% and +144.3% respectively, post Hellaby acquisition, taking into consideration that the acquisition effect was reflected in full 12 months in FY18 compared to 6 months in FY17. Assuming full year of FY17 to include Hellaby results, revenue increased +5.7% and EBITDA grew by +33.1% compared to pcp. BNT trade business (largest business of Bapcor NZ), achieved like for like sales growth of +6.1% reflecting the success of organisation changes, range expansion and market growth.

- Solid FY 19 Outlook. BAP expects continued revenue and profit growth. Management noted that consensus estimates of EBITDA of $170m are reasonable, and they expect increase in NPAT of 9%-14% above FY18 proforma NPAT. We note that our valuation numbers are on lower end of guidance or the conservative side.

FY18 results by segment…

Figure 3: Segment results

Source: Company

Figure 4: BAP Comparables

Source: Company

Figure 5: BAP Financial Summary

Source: Company

COMPANY DESCRIPTION

Bapcor Ltd (BAP) is Australasia’s leading provider of aftermarket parts, accessories and services. The core businesses of BAP are: 1. Trade – Burson Auto Parts is a trade focused parts professional supplying workshops with all their parts and accessories. 2. Retail – Autobarn is the premium retailer of auto accessories and Opposite Lock specialises in 4WD accessory specialists. 3. Independents – supporting the independent parts stores via the group’s extensive supply chain capabilities and through brand support. 4. Specialist Wholesaler – the number 1 or 2 industry category specialists in parts supply programs. 5. Services – experts at car servicing through Midas and ABS.

This Week’s News

7 August 2019